First Time Home Buyers and Down Payment Programs

A recent Harris Poll survey revealed that homeownership remains a significant priority for 8 out of 10 Americans, with 28 million individuals planning to purchase a home within the next 12 months. It's no surprise that the allure of homeownership extends far beyond financial gains, motivating a vast number of individuals to embark on this journey. However, when asked about the obstacles hindering their pursuit of homeownership, survey respondents provided the following insights:

34% expressed concerns about insufficient savings for a down payment.

30% highlighted challenges related to their credit score.

Besides Downpayment, What Else to keep in Mind

Account for closing costs: When budgeting for your down payment, it's crucial to consider the closing costs, which typically range from 2% to 5% of the home's purchase price. Be sure to factor this into your savings plan.

Preserve your savings: While saving for your down payment, it's essential to maintain a portion of your savings for post-purchase homeownership expenses. Having a financial cushion after moving into your new home can provide peace of mind and cover unexpected costs that may arise.

Explore and seek guidance: Take the time to explore all available options and resources tailored to homebuyers like yourself. Don't hesitate to rely on the expertise of a trusted advisor who can provide valuable guidance throughout the process. Conduct thorough research, ask relevant questions, and leverage the knowledge of professionals in the field.

Boosting Your Credit Score

Your credit score is a crucial indicator of your financial reliability in the eyes of lenders. A higher credit score opens doors to greater borrowing capacity and secures more favorable interest rates. If a less-than-optimal credit score is in the way of obtaining an affordable mortgage, take proactive steps to enhance it. Here are two actionable strategies:

Timely Bill Payments: Consistently paying your bills on time significantly improves your credit score. By ensuring prompt payment, your score rises, while any delays have a negative impact. Simplify the process by setting up automatic payments wherever possible, easing the burden of managing bill deadlines.

Diversify Your Credit Portfolio: Embrace a diverse range of credit types, such as auto loans, credit cards, and mortgages, to enhance your credit score. Demonstrating responsible management across various credit categories boosts your score and showcases your ability to handle different financial obligations effectively.

Fix Your Credit: For those needing assistance with credit repair, it is comforting to know that there are professionals who specialize in this area and can offer valuable help. These credit repair specialists possess the expertise to analyze your credit report, identify areas for improvement, and create a customized plan to boost your credit score. By seeking their guidance, you can benefit from personalized strategies and practical solutions to address credit challenges, empowering you to navigate the credit repair process confidently. With their support, you can take the necessary steps to achieve a healthier credit profile and work towards your financial goals.

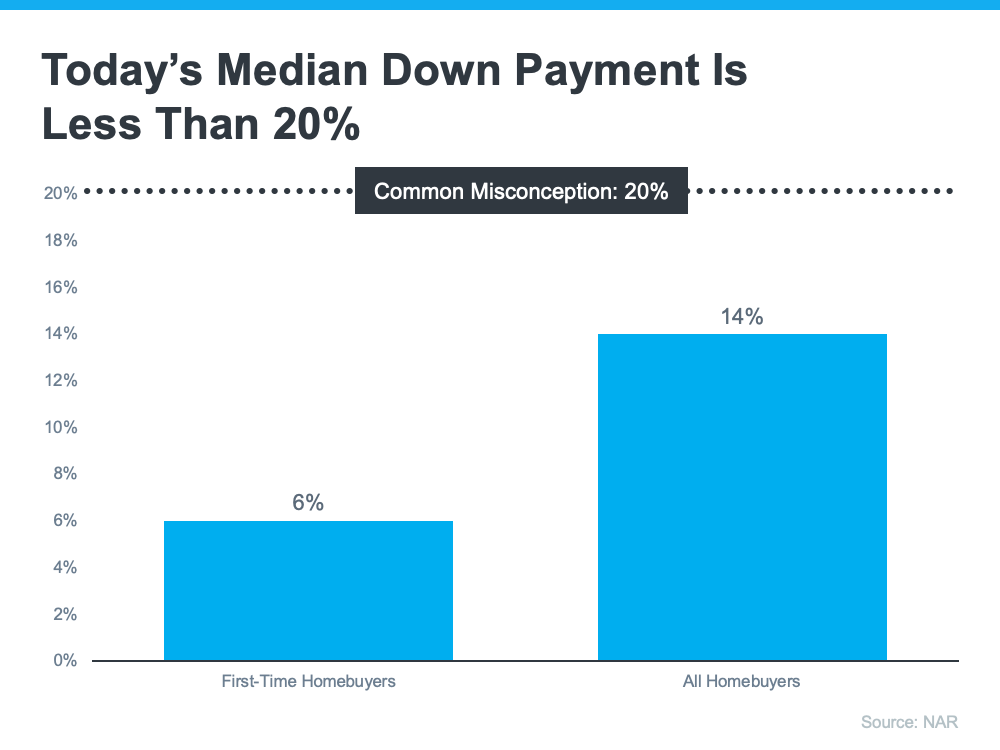

Dispelling the 20% Myth

If you're a first-time homebuyer, you might be concerned about saving for a hefty down payment. However, the notion that you must put down 20% is often misleading. Let's uncover the truth and discover how much you need. National Association of Realtors (NAR) states:

“One of the biggest misconceptions among housing consumers is what the typical down payment is and what amount is needed to enter homeownership.”

Freddie Mac survey states:

“. . . nearly a third of prospective homebuyers think they need a down payment of 20% or more to buy a home. This myth remains one of the largest perceived barriers to achieving homeownership.”

Here's some encouraging news: In most cases, putting down 20% of the home's purchase price is not mandatory unless specified by your loan type or lender. This realization brings you closer to achieving your dream of homeownership than you might have thought.

Recent data from the National Association of Realtors (NAR) reveals that the median down payment has remained below 20% since 2005. Currently, the median down payment for all homebuyers is a modest 14%. It's even lower for first-time homebuyers, with a median down payment of just 6%. These figures demonstrate that the initial financial hurdle of a down payment is more attainable than commonly believed.

Unlocking Down Payment Assistance

Down payment assistance programs are not limited to first-time buyers. A wide range of options are available to first-time and repeat homebuyers. Let's explore these programs and loan types that can ease the burden of saving for a down payment.

Down Payment Resource reveals an extensive range of over 2,000 homebuyer assistance programs. These programs are primarily designed to provide support for down payments. This abundance of options demonstrates the commitment to helping individuals achieve their homeownership goals and underscores the significance of exploring these valuable resources.

A quick search will allow you to discover the specific programs and assistance available in your state, providing you with a clear understanding of what you may qualify for. Take advantage of this opportunity to uncover the resources to help turn your homeownership aspirations into reality.

Down payment resources and myths about 20% down is examined.

Furthermore, various loan types provide additional flexibility regarding down payments. For instance, FHA loans offer the possibility of a down payment as low as 3.5%. In addition, options such as VA loans and USDA loans are available for qualified applicants, eliminating the need for a down payment. These loan programs present alternative pathways to homeownership, accommodating a range of financial circumstances and making the dream of owning a home more attainable for eligible individuals.

First-Time Homebuyers

Buying your first home involves various expenses beyond the down payment. From closing costs to initial fees, these financial obligations can seem overwhelming. Discover how public and private first-time homebuyer programs can help you navigate these challenges.

The current housing market presents unique obstacles for first-time home buyers, including a need for more available properties and elevated interest rates. These factors have caused many prospective buyers to hesitate and reconsider their options. In light of these challenges, it becomes even more crucial for you to proactively navigate the path to homeownership, overcoming these obstacles with determination and informed decision-making.

The National Association of Realtors (NAR) states:

“Since 2011, the share of first-time home buyers has been under the historical norm of 40% as buyers face tight inventory, rising home prices, rising rents, and high student debt loads.”

First-Time Home Buyer Programs

The journey of purchasing your first home can present numerous financial challenges, including obtaining a loan, saving for a down payment, and covering closing costs. These expenses may seem daunting and create hurdles on your path to homeownership.

However, the good news is that an array of public and private first-time homebuyer programs are available to support you in overcoming these challenges. These programs are designed specifically to assist individuals like yourself in securing a loan with minimal upfront costs, enabling you to take significant steps towards homeownership with greater ease. By exploring these programs, you can find valuable resources and financial assistance to make your dream of owning a home a reality.

CNET explains:

“A first-time homebuyer program can help make homeownership more affordable and accessible by offering lower mortgage rates, down payment assistance, and tax incentives.”

According to Bankrate, state and local governments make a wide range of these programs available.

“Many states and local governments have programs that offer down payment or closing cost assistance – either low-interest-rate loans, deferred loans or even forgivable loans (aka grants) – to people looking to buy their first house . . .”

Broadening Your Choices with Condos and Townhomes

Finding an affordable home can be challenging in a competitive seller's market. Consider expanding your options by exploring condominiums and townhomes. Learn how these housing types offer affordability, lower maintenance, and the opportunity to build equity.

Us News States:

“Condos are usually less expensive than standalone houses . . . They are also less expensive to insure.”

Us News continues: “The strongest reason for purchasing a condo is that all external maintenance is usually covered by the condo association, such as landscaping, pool maintenance, external painting, paving, plowing, and more. This fee also covers internal maintenance, such as gas, electric, plumbing, HVAC, and other mechanical systems.”

A Pathway to Financial Growth

Owning a home is a stepping stone toward financial stability and wealth building. By gaining equity and increasing your net worth, you open doors to future opportunities. Discover why townhomes and condos can be excellent entry points into homeownership.

Conclusion

Homeownership remains a top priority for most Americans, as a recent Harris Poll survey revealed. Overcoming common obstacles, such as saving for a down payment and improving credit scores, requires proactive steps and informed decision-making. Fortunately, diverse resources and assistance programs are available to support homebuyers on their journey. Exploring down payment assistance, diversifying credit portfolios, and considering alternative housing options like condos and townhomes can further expand opportunities. With careful planning, expert guidance, and the right financial strategies, homeownership can be a reality for aspiring buyers.

Are you considering purchasing your first home or looking to make a repeat purchase? At Philippe Properties, we understand that knowledge is power in the real estate market. We offer a complimentary consultation to provide valuable insights and guidance. This opportunity will help you understand the home-buying process and make informed decisions. Contact us today to schedule your consultation and empower yourself with the knowledge to embark on a successful home-buying journey.