Latest Data on Home Prices

Despite the alarming wave of negative headlines last fall predicting another housing crash akin to the 2008 financial crisis with plummeting prices of 20% to 25%, all those claims turned out to be entirely false. Nevertheless, the resonance of these statements had a profound impact on the psyche of the American consumer. Examining the end-of-year data from December, spanning back to 2010, when the survey was first conducted, we observe a significant increase in the percentage of Americans anticipating a decline in housing prices over the next 12 months during the initial years of recovering from the financial crisis, peaking at 18% to 17%. However, as time progressed, sentiments improved, and things appeared to stabilize. That is until 2022, when the figure skyrocketed to an all-time high of 37%, nearly doubling the previous record. This surge can be attributed to the abundance of negative headlines throughout the year, perpetuating fears and apprehensions among the populace.

Despite dire predictions from renowned economists and global banks that real estate prices would experience a catastrophic decline, the anticipated crash did not materialize. On the contrary, the real estate market displayed remarkable resilience, defying expectations and earning accolades for its endurance. The perception among consumers has also shown improvement, with only 31% of Americans now believing that prices will decrease in the coming year, compared to the higher figure of the previous month. However, it is noteworthy that one in three Americans still believes prices will decline in the next 12 months, indicating a lingering cautious sentiment.

Signs of Stabilization

Contrary to pessimistic predictions of an escalating downward spiral, the real estate market has defied expectations and shown signs of recovery. While the worst month was observed in August, recent data from Case-Shiller indicates a positive trend in home values, with consecutive months showing stabilization rather than decline. Compared to the prolonged recovery period following the 2008 crisis, the current market is exhibiting a much faster rebound, with prices potentially reaching a positive state within six months. Case-Shiller and the FHFA affirm the trend of stabilizing prices, albeit with slight variations in their respective data. Overall, the real estate market is displaying signs of a comeback after a challenging second half of the previous year.

Analyzing Trends across Top Home Price Indexes

CoreLogic is also saying that prices are stabilizing. The same trend is evident, even though they use a slightly different data set, so their numbers may match differently. But if you look at the trend, it's clear. The trend is unmistakable if we combine CoreLogic, Case-Shiller, and the FHFA findings. These are three of the most trusted home price indexes, and they're all pointing to the same conclusion. We had a great start to 2022, then a difficult second half, but now we're bouncing back. We can't guarantee that everything will continue to improve, but we'll keep you updated. However, the fear of a drastic 20-25% drop isn't likely.

Zillow and Fannie Mae's Perspective: A Rollercoaster Market Trend

What's Zillow's take on this? They echo the others: a solid first half last year, a downturn in the second half, but now a rebound. What about Fannie Mae? Their approach is slightly different as they assess trends quarterly rather than monthly. But their conclusion is similar. They saw a strong 2021 and a great first half of 2022, followed by a drop in the second half. However, the first quarter of this year marked a recovery. We're still waiting on their second-quarter numbers. It's an interesting pattern.

Understanding Current Trends: Comparing to the Pandemic Years

Now, let's dive more profound, as some people may suggest that this year's results could be better compared to the previous year. Yes, but what are we comparing them to? "In 2022, appreciation fell to 5%. When people say the market is slow or the appreciation is moderate, these are the regular markets. You’re comparing it to the pandemic years, the two most exceptional years in American real estate history, which was an anomaly, an event that wasn't expected to occur.

People often compare current trends to the pandemic years. But is that fair? It's more reasonable to compare current events with the regular years before the pandemic. If we do that, you'll see that home appreciation is about the same.

Showing Time Data

You might ask, "What about the number of potential buyers looking at houses? Isn't that down?" Yes, if we compare it to the pandemic years, it is. But let's consider the 'normal' years of 2017 to 2020. The number of buyers is higher now.

Days on the Market

And what about the median days on the market? Are they up significantly? Compared to what? The pandemic years? Sure, but from 2017-2020, houses are selling faster than in typical years.

Let's make sure we're making a fair comparison here. Contrasting the current market with the usual years, not the extraordinary pandemic years, is more reasonable.

Inventory Levels are Rising

Does that mean we're in a lousy market with more houses for sale? Consider what you're comparing it to. Ah, the pandemic years. Instead, let's compare it to the regular years before the pandemic. Remember, 2020 started with a bang. We ended 2019 on a high note, with many listings. Even though many of these listings had fallen off by May, we started with so many that the drop was insignificant as the 927.

We currently need more listings. If the mortgage rate dips below 6%, the inventory challenge we're seeing now will intensify. You can expect potential buyers to queue up around one block.

The inventory numbers for April are higher. But higher compared to when? The pandemic years. However, if we look back at 2017, 2018, 2019, and 2020, the inventory numbers aren't up; they're down. We're in dire need of listings.

Los Angeles Housing Market's Latest Data

In the previous year, increased mortgage interest rates put a damper on the once-booming housing market in Southern California. This led to a decline in buyers, a significant drop in sales, and the first long-lasting decrease in home prices in ten years.

According to one estimate, prices in the six-county area have dropped 13% from their highest point last spring. Redfin data shows that some properties receive multiple offers, with average homes selling around 1% above the asking price and becoming pending sales in approximately 39 days.

However, homes priced and marketed well and located in prime areas can sell for roughly 5% above the list price and become pending sales in about 19 days. In May 2023, there was a 9.95% decrease in Los Angeles home prices compared to the previous year.

Current Market Rates and How it Affects the Market

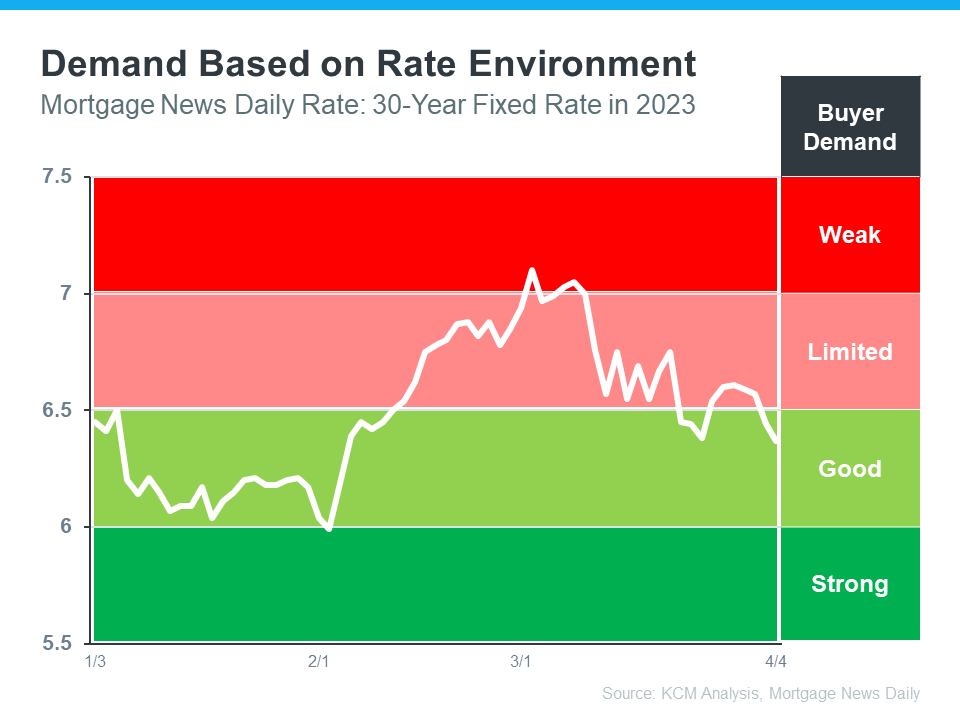

Currently, the interest rates are at 6.69%. It's observed that when the rates surpass 6.5%, buyers tend to pull back. As a result, the Los Angeles housing market is currently experiencing some stagnation, primarily due to these higher interest rates.

Conclusion

While last year was tumultuous, and dire predictions caused a wave of apprehension, the real estate market has proved resilient. Despite mortgage rates and other challenges, recovery signs are evident across significant home price indexes. While it's essential to remain informed about potential risks, it's equally important not to let fear drive market perceptions. With the proper perspective and careful comparison to both ordinary and extraordinary years, we can see that the current state of the market is more cheerful than some have suggested. Understanding these trends and adjusting expectations can help buyers and sellers navigate the housing market more confidently.