Weekly Real Estate Digest Los Angeles

Unveiling Unemployment and Recession Trends

In the realm of economic dynamics, one fact stands tall: historically low levels of unemployment have cast a glimmer of optimism, yet, an undercurrent of concern about impending recession tugs at our minds. The question begs to be asked: Is a recession truly looming on the horizon?

The notion of a gentle economic descent appears to be slipping through our fingers. An air of uncertainty prevails as economists present a somewhat balanced view—almost like a coin flip—with odds hovering around the 50/50 mark. As we ponder this, let's traverse this economic terrain with acumen and insight.

Unraveling the Unemployment Paradox

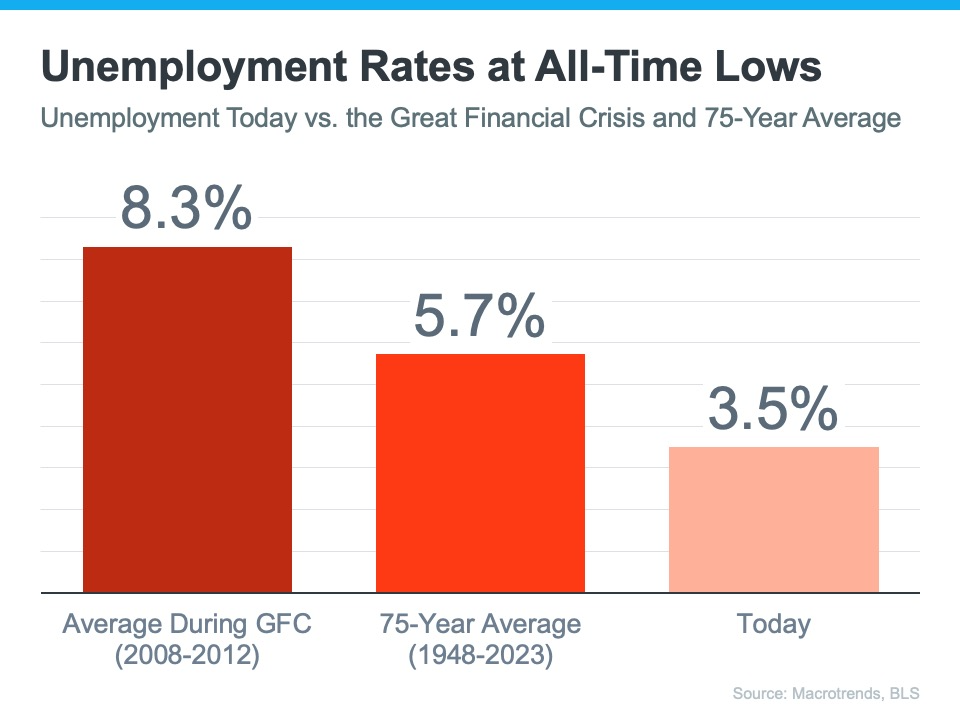

The tapestry of unemployment is woven with complexities. Picture this: If the unemployment rate scales the heights of five or 6%, it doesn't necessarily foreshadow a torrent of foreclosures. The secret lies in comprehending the historical lows we stand on today. We currently bask in a 3.5% unemployment rate, which contrasts vividly with the 75-year average, acting as our beacon of reassurance.

Historical benchmarks have their place, too. A glance back to the tumultuous years of 2008 to 2012 reveals an average unemployment rate of 8.3%. This historical juxtaposition helps to temper our fears. While an uptick in unemployment is possible, revisiting that bygone era is not. The past does not dictate our present course. So, even if we nudge towards the 75-year average, it need not spell foreclosure havoc.

Understanding Mortgage Debt: The Balanced Equation

Amidst discussions of mounting mortgage debt, let's not succumb to a mere numbers game. The staggering $12 trillion mortgage debt figure can be daunting, but true comprehension delves deeper. The ratio of this debt to income is the crux. And yes, debt numbers naturally rise as more people embrace homeownership and property values ascend. A long-term view is crucial. Mortgage debt will naturally swell as property values elevate over the next three decades. The key lies in maintaining harmony between this growth and income levels.

Forbearance: Lessons from the Past

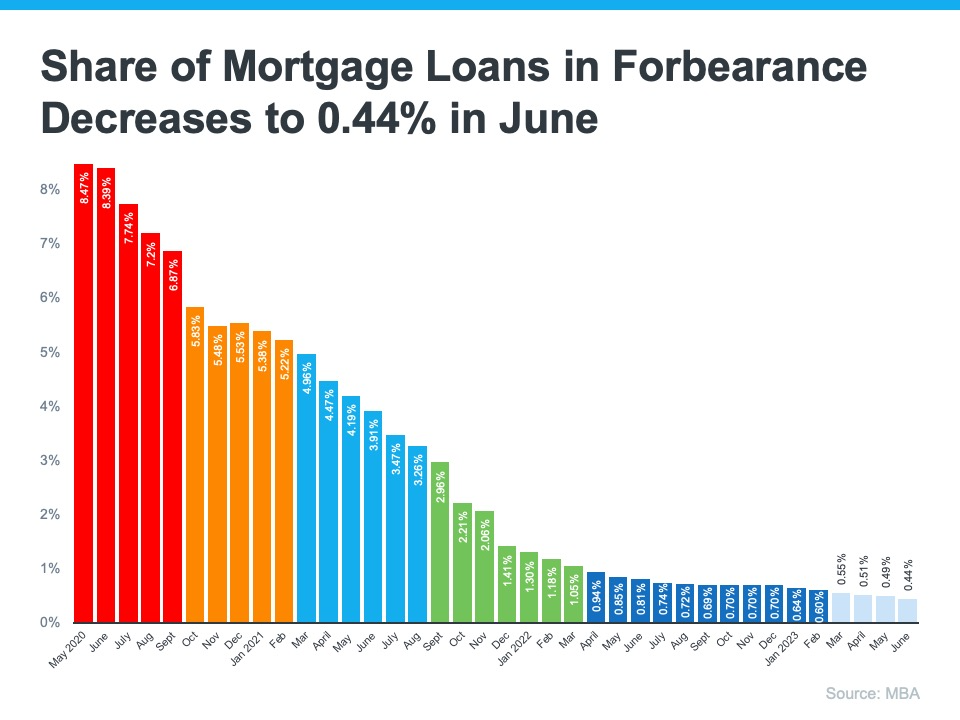

Enter the realm of forbearance, a lifeline during economic tempests. The government's intervention served as a cushion, preventing countless families from losing their homes to foreclosure. A marvel of efficacy, the forbearance program saw fewer than half a percent of mortgages currently seeking this refuge. Such success is a testament to its value and the judiciousness of employing it.

Foreclosures: A New Paradigm

Gone are the days of a foreclosure epidemic reminiscent of 2008. Banks, armed with lessons from the past, offer a lifeline to homeowners in need. The stark contrast between then and now is undeniable. Rather than reliving history, our path leads us toward a realm akin to the stability and resilience of 2016, 2017, and 2018.

Equity: Our Pillar of Strength

Equity emerges as our steadfast ally, guarding homes against uncertainty's grip. Over a third of homes stand free of mortgages, while another substantial portion boasts more than 50% equity. Negative equity's specter is a faint memory, with the lowest figures in over a decade. The narrative of stability prevails.

A Glimpse into the Future

Bill McBride, the economist from calculated risk who foresaw the 2008 foreclosure storm, now asserts with certainty: "There will not be a foreclosure crisis this time." The equity gain and substantial labor market numbers give us an insight different than the terrifying headlines. The inventory still remains a challenge.

Let knowledge be your guiding star as you navigate these intricate economic waters. Armed with insights, you can tread confidently, ensuring that the course you chart is one of financial security and understanding.