Escrow Process for Sellers and Buyers in Real Estate

Mastering Escrow in California: Your Guide After Offer Acceptance

Congratulations! Now that your offer has been accepted, you are in escrow. You've overcome the challenge of having your offer accepted after extensive negotiations, or you had your offer accepted on the first try. But what exactly is escrow?

What is Escrow?

Escrow ensures a secure property transaction where the seller gets paid and the buyer gains legal ownership, handled by a third-party neutral. This process applies to property purchases, sales, or refinances. An impartial escrow holder diligently follows written instructions, managing funds and documents and delivering them to the proper parties upon successful escrow completion. To facilitate the transaction, essential information like loan documents, tax records, insurance policies, and sale terms must be provided to the escrow.

Typically, an escrow company selected by the seller will provide detailed instructions. You must deposit earnest money into escrow within three business days of acceptance to show good faith and follow the contract. However, it's essential to be cautious of wire fraud, which has become widespread. Always verify the authenticity of any communication regarding the earnest money deposit and down payments.

Who is the escrow holder or escrow officer?

In an escrow process, an authorized middle person, the escrow holder, also known as an escrow officer, plays a crucial role. They are licensed by the state and are responsible for handling deposits and documents for all parties involved in the escrow. The escrow holder's primary responsibility is to remain loyal and honest to everyone in the escrow process. They need to follow all instructions given by the parties involved in the escrow to ensure a successful transaction.

Moreover, the escrow holder ensures that all parties in the transaction adhere to the rules mentioned in the instructions. They also coordinate with other professionals, such as lenders, title companies, and real estate brokers, to ensure everything runs smoothly.

Buyers Obligations During Escrow

1- Physical Contingency-Buyer’s investigation of the Property

In California, the inspection period contractually is done within 17 days unless it is shortened and agreed upon otherwise. During this time, hiring experts to examine the property thoroughly is essential. For a single-family home or multi-unit purchase, you'll need a general home inspection, termite inspectors, sewer specialists, and mold experts; additionally, various inspections may be required depending on the house and based on factors such as whether the house has a chimney or pool, is on a hillside, or has specific foundation needs.

If you're buying a condo, the inspection typically involves a general home inspector and mold since the Homeowners Association (HOA) takes care of common areas and external aspects of the building, such as the roof and sewer systems. This is why condo owners pay monthly HOA fees.

Ensure that your inspectors are licensed, have appropriate accreditation by your state, and have errors and omissions insurance.

Questions for a Home Inspector

1-Are you licensed or certified for home inspections?

2-How many years of experience do you have in this field?

3-What is your fee or pricing structure?

4-Could you be able to provide a detailed list of what you typically inspect?

5-Are there specific areas or items you do not inspect as part of your service?

6-When can I expect to receive the inspection report after completion?

7- Would you please provide a sample inspection report?

8-Do you carry errors and omissions insurance for your services?

General Home Inspections, What to Expect?

A qualified home inspector will examine the heating and cooling system, assess water and plumbing, inspect electrical work, check for mold and mildew, check the roof, and identify potential fire and safety hazards. The primary responsibility of a general home inspector is to pinpoint property issues. It's their job to uncover any faults or problems within the house meticulously. Still, it's important to note that many of these issues are manageable unless you deal with significant foundation problems or structural shifting. For first-time home buyers, the inspection findings can be daunting and nerve-wracking. However, it's essential to remember that you've already come a long way in a challenging housing market with limited options. Most items on the inspector's list can be addressed over time, so there's no need to feel overwhelmed by the long list of potential fixes.

For instance, if the home inspector uncovers issues like a faulty electrical system, plumbing problems, or a crack in the foundation, it's advisable to engage qualified professionals such as electricians, plumbers, or foundation specialists to get to the bottom of the issues. They can provide you with precise estimates for the necessary repairs. Armed with these estimates, you can approach the seller with a reasonable request for a credit or fix the issues at hand.

Request for Repairs

When requesting a credit, it's crucial to build a solid case. Rather than throwing out an arbitrary figure, it's best to be precise. For example, if there's a safety concern with the electrical system that could lead to fire or electrocution, and the estimated repair cost is $20,000, or if sewer hydro-jetting is needed for $1,000, you can make a specific request for a credit of $21,000 or explore negotiation options for a partial credit or ask the seller to fix the issues.

In a competitive real estate market, sellers may not be inclined to offer credits, especially when facing multiple offers or even if you are the only offer. It's essential to be prepared for various responses from the seller to avoid disappointments. Remember, sellers are not obligated to provide any credits. Maintaining a respectful approach is crucial; avoid overwhelming the seller with requests for minor repairs. Instead, focus on health and safety concerns like addressing mold issues or faulty electrical.

One advantage of being in escrow is that buyers have some leverage. If the home buyers back out, the home sellers would need to put the property back on the market and disclose their findings to potential new buyers, which could prolong the time the property spends on the market and deter other buyers. Generally, if you approach the situation diplomatically, sellers are often willing to cooperate with buyers. Additionally, the longer the escrow remains open, the more negotiating leverage the buyer tends to have.

After completing all your inspections and agreeing with the seller regarding any credits or non-credits, upon reviewing the seller's property disclosures and ensuring a clean and easily transferable title, and so on. When you are confident and comfortable with all the disclosures and findings, you can eliminate your initial contingency, referred to as the "physical contingency." This step takes you deeper into the legally binding contract. However, it's crucial to be sure before removing this contingency. If you find the need to withdraw from the deal, you have the right to do so and recover your deposit. The physical contingency ensures the house meets your expectations after inspections.

Appraisal Contingency

The appraisal contingency comes into play when you get a loan, ensuring the property's appraised value aligns with your purchase price. The bank determines the property's appraised value and will provide a loan based on the appraised property value. For instance, if you're purchasing a $1 million house, but the appraisal values it at $900,000, the lender will only loan you $900,000. If you lack sufficient reserves, this might jeopardize the deal. Your options are to cover the difference from your funds or negotiate with the seller to adjust the price to $900,000 or closer to the number you can agree on to proceed with the transaction.

Loan Contingency

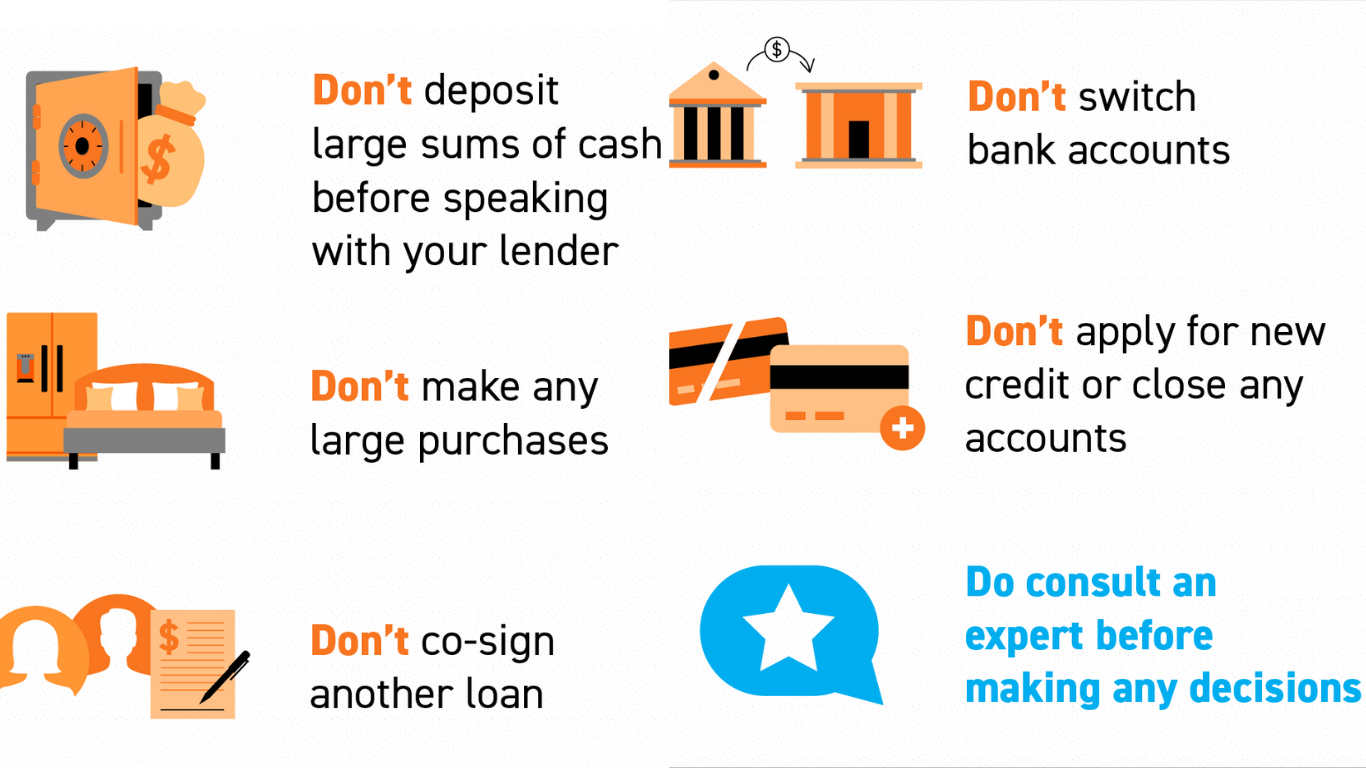

Loan contingency ensures you are qualified to purchase the house. The underwriter carefully reviews all your finances to ensure you meet the qualification criteria. Avoid making significant purchases or cosigning with anyone during escrow. Be conservative with expenses until the escrow is complete, as a significant purchase like a Mercedes could impact your debt ratio and potentially jeopardize your dream home purchase.

Title

When reviewing a title report, it's essential to consider various factors. Property taxes may sometimes be delinquent but typically settled from the sale proceeds. Additionally, you should watch out for any mentions of mortgage liens, judgments, and bankruptcy records.

You're in good shape as long as the title is clear for transfer. While some issues may arise during escrow, it's essential to remember that specific problems can be resolved while others may not. Your primary goal is to ensure a clear title for the property transfer. Your title officer is here to assist you with any questions and provide guidance, helping you navigate through inquiries and swiftly resolve any potential issues that may arise during the process.

Home Insurance

Don't forget to secure homeowner's insurance, as it's often required before you can finalize the sale. Make sure to consider insurance coverage for fire, earthquake, and flood. Shop around to find the best rates and options, and don't hesitate to ask the right questions to make an informed choice.

Home warranty

Sellers often include a one-year home warranty as part of the package unless agreed otherwise. The home warranty covers various scenarios, including roof leaks or appliances that aren't functioning correctly, electrical systems, heating and cooling systems, garbage disposals, doorbells, ceiling fans, and even rekeying services. This added benefit assures buyers that they can address potential issues with these critical components during the first year of homeownership. The home warranty will offer you the services they provide in detail.

Final Walk Through

The final walk-through is crucial to confirm that the property matches or surpasses the condition you initially saw it in. It takes place five days before the close of escrow. This is not a contingency; it's your last inspection before closing the deal. The insurance will kick in if significant damage occurs during escrow, like a fire or flooding. Please ensure all appliances work correctly and the garage door operates smoothly, and carefully check for any signs of leaks throughout the property. This is to let you know that you can assess the home before signing the loan documents and proceeding with the closing process. If you have any specific requests from the seller, such as disposing of unwanted furniture, this is the right time to address them.

Recording of the Deed

The buyers will sign the loan documents, and the down payment will be transferred to the escrow account. After all the funds have been distributed, the title company will proceed to record the deed in the name of your choice, whether it's your name, a trust, or an LLC. Congratulations, you are now the official owner of the property.

Home Buyer Closing Cost

Closing costs in California can vary based on several factors, including the final sale price, transaction complexity, and negotiation agreements between the buyer and seller. Typically, home buyers in California can expect to pay closing costs ranging from 2% to 5% of the purchase price. For instance, on a $1,000,000 purchase, a typical buyer might incur costs between $20,000 and $50,000 in closing costs.

These closing costs encompass loan origination fees, appraisal fees, title and escrow fees, attorney fees, and any discount points chosen for payment at closing. Some fees, like an appraisal, underwriting-processing, credit report, notary, and recording fees.

On average, property taxes in California amount to around 1.25% of the purchase price per year.

Home Seller Closing Cost

The closing costs in California can vary quite a bit, but one of the significant expenses is usually the real estate commission. This commission typically falls between 5% to 6% of the purchase price. Depending on their commission negotiation agreements, sellers often set aside around 6% to 7% of the purchase price to cover these costs.

For sellers in California, other closing costs may come into play, such as escrow fees, title insurance, county transfer taxes, city transfer taxes, and various miscellaneous items. It's important to note that some of these costs can vary based on the specific county and city where the property is located.

Conclusion

Whether you're a first-time buyer eager to find your dream home or a seasoned homeowner looking to sell and move on to new horizons, the intricate world of escrow can be intimidating. That's why having an expert by your side is invaluable.

We're here for you every step of the way, whether you're buying or selling, ready to guide you through all your real estate transactions. When you partner with us, you're not just receiving a service; you're gaining a trusted ally committed to helping you navigate obstacles and reach your goals successfully.