Mortgage Rates: Insights into 2023 and 2024

If you plan to purchase a house this year, you're likely keeping an eye on mortgage rates. These rates influence how much you can borrow for a home loan, and with the current challenges in affordability, it's helpful to compare current mortgage rates with their historical figures. Moreover, knowing how these rates connect with inflation can hint at their direction in the upcoming days.

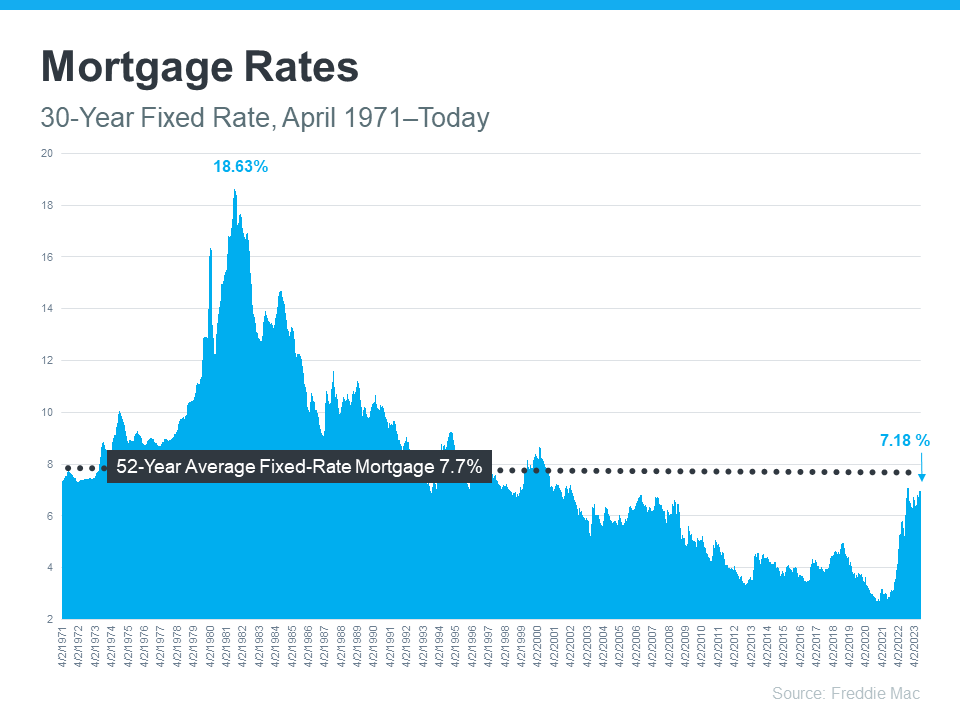

Freddie Mac has been monitoring the 30-year fixed mortgage rate since April 1971. Each week, they share their Primary Mortgage Market Survey findings, which compiles mortgage application details from national lenders. Observing the latest trends on the chart, there's been a noticeable increase in mortgage rates from the beginning of the previous year. However, current rates remain below the 52-year average. It's worth noting that over the last 15 years, buyers have become accustomed to rates ranging between 3% and 5%.

This matters because the recent rate surge might seem surprising, even if it aligns with the long-term average. Even though many prospective homeowners have adapted to the higher rates over the past year, a slight decrease would be advantageous. To see if a drop is plausible, it's crucial to examine inflation.

Where Might Mortgage Rates Head Next?

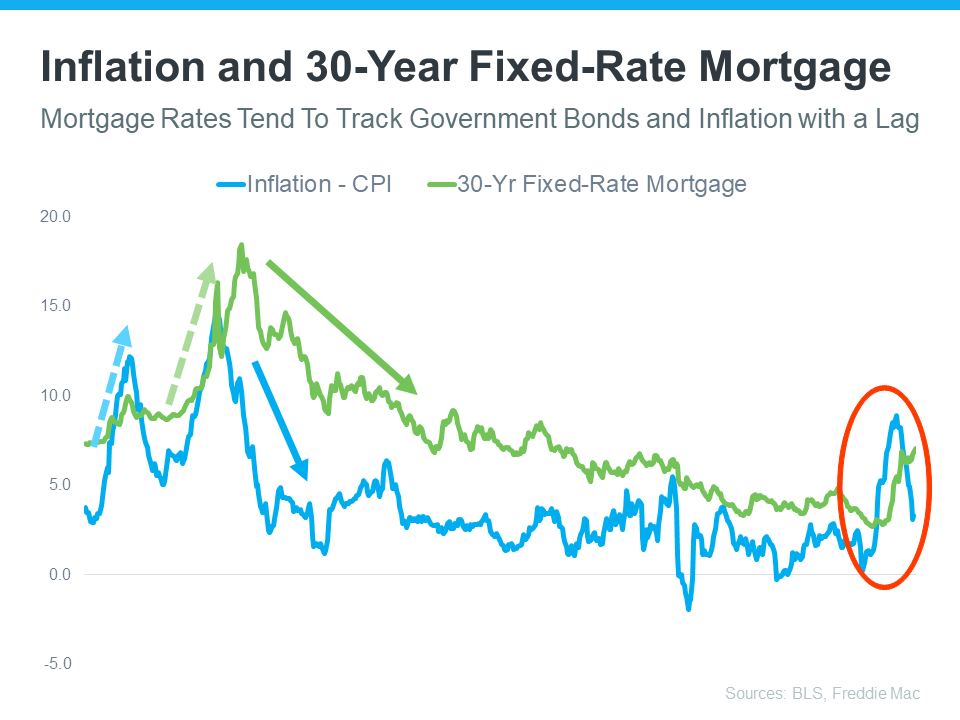

Since early 2022, the Federal Reserve has been actively trying to curb inflation. This is noteworthy since, over the years, there's a recognized link between inflation and mortgage rates. Typically, when inflation rises, mortgage rates tend to follow suit to counterbalance the decreased purchasing power of money. Conversely, mortgage rates stabilize or decrease when inflation is kept in check. Therefore, the efforts of the Federal Reserve to manage inflation can provide hints about the potential trajectory of mortgage rates in the upcoming period.

This chart clearly illustrates the consistent relationship between inflation (blue) and mortgage rates (green). On the left side of the chart, it's evident that whenever inflation experiences a noticeable shift, mortgage rates tend to respond similarly not long after.

The highlighted section of the graph emphasizes the recent surge in inflation, with mortgage rates closely mirroring this rise shortly after that. However, even though inflation has somewhat settled this year, we haven't seen a corresponding decrease in mortgage rates.

Given this historical context, the market seems poised for mortgage rates to mirror inflation's recent decrease eventually. While it's challenging to pinpoint future mortgage rates with certainty, the recent stabilization of inflation suggests that a downward trend in mortgage rates could be on the horizon, aligning with historical patterns.

As of September 7, 2023, the average interest rate for a 30-year fixed mortgage stands at 7.18%. This is a notable increase, roughly 2% more than the rate around this time the previous year. This marks the steepest average mortgage rate we've seen in two decades.

Selma Hepp, the leading economist at CoreLogic, a prominent real estate data and analytics company, stated: "As individuals deplete their pandemic-induced savings, we'll witness a deceleration in spending, which will subsequently affect the overall economy. Additionally, we're seeing a surge in fuel and food prices, which undeniably influence household expenditures — a trend the Federal Reserve is keenly monitoring. By either the first or second quarter of 2024, there's a likelihood that the Fed will intervene, offering respite to these households by slashing interest rates, thereby making borrowing more affordable. Nonetheless, by the year's close, we anticipate mortgage rates to hover around the 6.5% to 6.8% mark."

Observers of the housing market remain optimistic that the zenith of mortgage rates was reached this autumn, anticipating a consistent decrease from this point forward. Nadia Evangelou, a high-ranking economist and head of predictions at the National Association of REALTORS, foresees that mortgage rates will stabilize under 6% with reduced fluctuations this year.

Mortgage Rate Forecast: A Glimpse into 4th Quarter of 2024

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

Venturing into the last quarter of 2023 and peering into 2024, we see intriguing shifts in mortgage rate forecasts. Eminent institutions, Fannie Mae, MBA, and the National Association of REALTORS® (NAR), have provided their projections. For Q4 2023, the rates are anticipated to be 6.60%, 5.90%, and 6.30% respectively. Taking an aggregate of these projections, the average rate for this period hovers around 6.27%. As we transition into 2024, potential homeowners and investors must watch these trends, as they often serve as a barometer for broader economic shifts. The dance of these numbers isn't just data; it's a story of a dynamic market in motion.

Conclusion: The future of mortgage rates remains an intricate dance of economic indicators, historical patterns, and the ever-watchful eye of institutions and market experts. Understanding these patterns and projections can provide potential homeowners and investors with a roadmap for making informed decisions in the ever-evolving housing market.