Inflation and Housing Market

What is Inflation?

Inflation means the average prices of things we buy in an economy increase over time. You can also think of inflation as the dollar buying a little less than it used to.

For instance, if there's a 2% inflation rate, a fridge you bought last year for $700 would cost about $14 more today. While $14 might feel like a minor deal for one item, if you think about everything you buy getting pricier, those extra costs can add up quickly.

Mortgage Professional America (MPA) puts it this way:

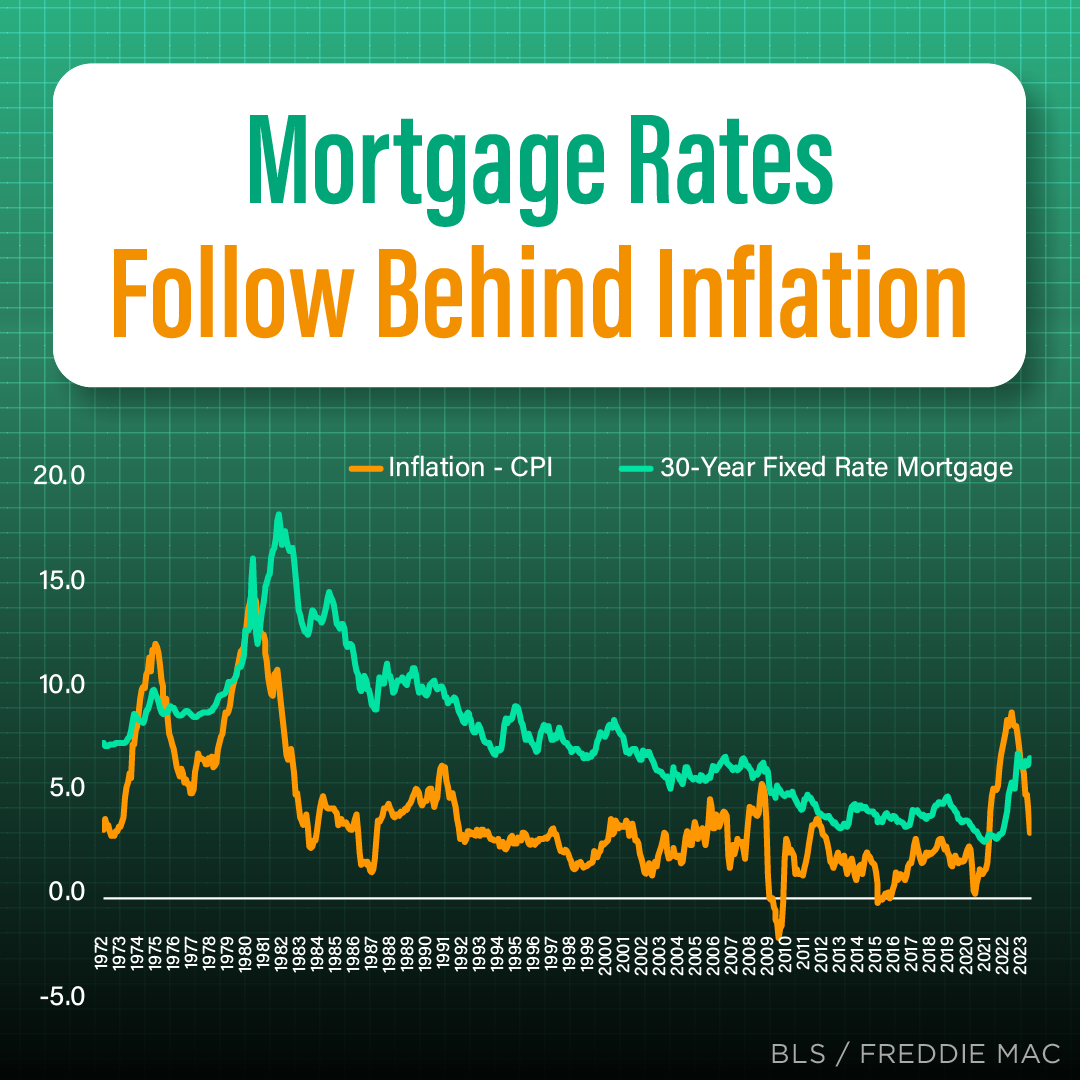

“. . . mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.”

“Even when inflation does come down consistently, it doesn’t mean prices are falling; it just means prices are not rising as fast.”

— GREG MCBRIDE, BANKRATE CHIEF FINANCIAL ANALYST

How Inflation and Housing Market Connect

Have you ever been curious about the link between inflation and housing prices? They go hand-in-hand, and shifts in one often influence the other. Let's dive into the basics of this connection.

Understanding Housing Inflation

Housing inflation, often termed 'shelter inflation'’ looks at how house prices change over time. The Bureau of Labor Statistics (BLS) carries out surveys where renters share their current rent prices while homeowners estimate how much they'd charge if they were renting out their homes.

In simpler terms, just as general inflation gives us an idea of how prices for everyday items like food and gas are moving, housing inflation tells us about the trends in housing costs. Interestingly, recent data suggests that housing inflation has declined for four months.

Why Does Housing Inflation Matter?

Housing costs play a significant role in the broader inflation picture. Shelter inflation constitutes nearly a third of the overall inflation, calculated using the Consumer Price Index (CPI). So, a change in housing inflation can cause noticeable ripples in the overall inflation rates. If housing inflation is dipping, the broader inflation rate may soon decrease.

Housing inflation refers to the rate at which housing prices grow. This data is sourced from a Bureau of Labor Statistics (BLS) survey, which collects input from renters about their rent costs and homeowners on potential rental values of their homes, should they decide not to occupy them.

This downward trend would undoubtedly be a positive signal for the Federal Reserve. Since the start of 2022, their efforts have focused on reigning inflation. Although they've seen progress (with a peak of 9.1% mid-last year), they aim to achieve a target of 2%. As of the latest data, it stands at 3.3%.

How Inflation Affects Real Estate

1. Borrowing Costs Increase:

During inflation, it can become more expensive for consumers to borrow money. This can make it more challenging for people to afford homes, as mortgage rates might rise.

2. Construction Costs Climb:

Inflation doesn't just affect homebuyers; it also affects builders. The costs of materials, labor, and machinery can go up. As a result, plans for new construction might be delayed or become more expensive.

3. Rise in Rental Rates:

With high inflation, securing a favorable mortgage might become difficult. This pushes more people to rent, causing a spike in demand for rental properties. With more people looking to rent and fewer new homes being built, rental rates can increase.

4. Property Values Appreciate:

High demand in the property market, coupled with reduced new constructions, can drive up the value of existing properties. So, during inflation, property values can see an upward trend.

5. Vacation Rentals May Struggle:

While regular properties might see a surge in demand, vacation rentals might not fare as well. As consumers reduce discretionary spending, these rentals might see less business.

6. Benefit for Current Property Owners:

Inflation can benefit those who already own property and have locked-in low-interest rates. Their property might appreciate while their mortgage payments remain the same.

7. Reducing the Impact of Old Debts:

Inflation can lessen the weight of past debts. In an inflated economy, while the nominal value of debt remains the same, its real value decreases, making it easier on borrowers in relative terms.

8. Real Estate as a Shield Against Inflation:

Investors often turn to real estate as a safeguard during inflation. While investments like stocks might dip with rising inflation, properties usually hold their value or even appreciate. Owning tangible assets, like real estate, can be a way to protect wealth during inflationary periods.

Inflation and the Central Bank's Actions

How is the Fed addressing rising inflation? By hiking up the Federal Funds Rate. This rate dictates the cost for banks to lend money to themselves. As inflation surged, the Fed boosted this rate to prevent the economy from getting too hot.

The Federal Reserve is increasing interest rates to control inflation. This move often leads to higher mortgage rates. Now, in 2023, loan rates are 7.18%. They may continue to rise, but they'll unlikely return to the low rates we saw before inflation hit.

Remember, rising prices also affect construction costs. This can make new homes pricier.

According to CPI data, housing inflation has remained persistently elevated for an extended period. However, economists believe it has peaked and is poised for a downturn.

“Shelter is still playing a big role in inflation, but that should be slowing in the second half of the year,” Jason Furman, an economist at Harvard University

"I'm as certain as one can be about this," said Mark Zandi, chief economist at Moody’s Analytics, referring to the imminent decline in housing inflation.

Conclusion: Inflation, a seemingly intangible concept, has concrete ramifications on everyday living, especially in sectors like real estate. As the prices of goods and services rise, the housing market responds in various ways, from increased construction costs to shifting mortgage rates. For homeowners and potential buyers, understanding the nuances of inflation can help make informed decisions in an evolving market.