Los Angeles Commercial Real Estate Market Trends

Office Space Los Angeles

Office Space Commercial Data Los Angeles

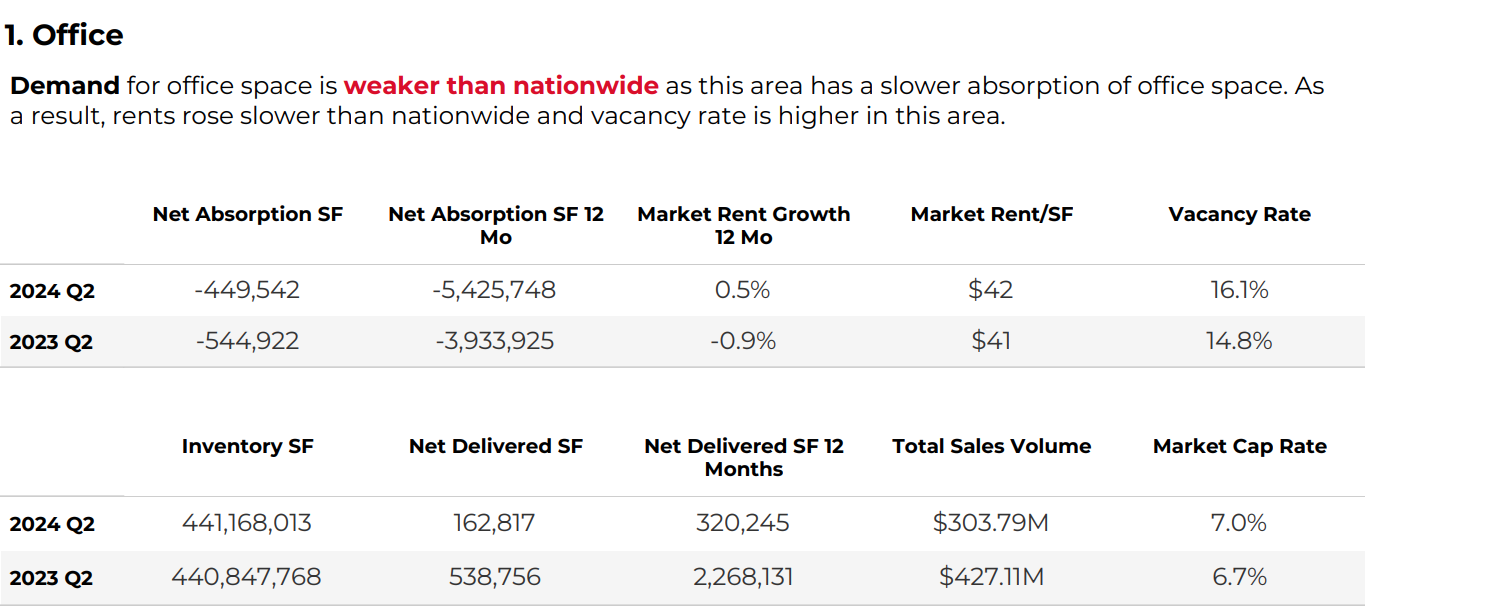

The demand for office space in Los Angeles is weaker than in other parts of the country. In the second quarter of 2024, more office space was left unoccupied (-449,542 square feet) compared to the same period in 2023 (-544,922 square feet). Over the past year, rent growth for office space was minimal at 0.5%, compared to a decline of 0.9% in 2023. The average rent per square foot increased slightly from $41 in 2023 to $42 in 2024.

The number of empty offices also increased, with the vacancy rate rising from 14.8% in 2023 to 16.1% in 2024. Additionally, fewer new office spaces were completed in 2024 compared to 2023. The total sales volume for office properties decreased significantly, from $427.11 million in 2023 to $303.79 million in 2024. This suggests that while there is still some activity, the market for office space is struggling, with fewer tenants and slower rent growth.

Multifamily Data Los Angeles

Los Angeles Multifamily Data Q2 2024

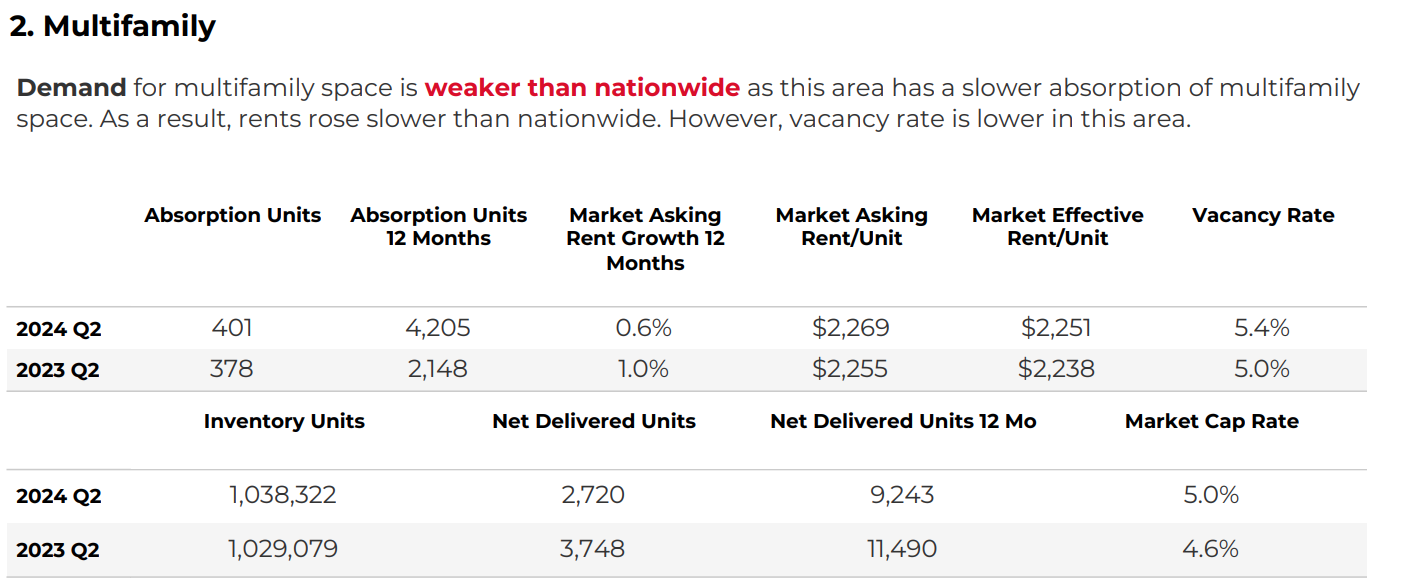

The demand for multifamily multi-units in Los Angeles is less strong than in other parts of the country. In the second quarter of 2024, only 401 units were rented out, slightly increasing from 378 units in the same period in 2023. Over the past year, there has been a small increase in rents, with the growth rate slowing to 0.6%, compared to a 1.0% increase in 2023. The average asking rent per unit in 2024 is $2,269, slightly up from $2,255 in 2023.

However, fewer empty units are available (a vacancy rate of 5.4% in 2024, up from 5.0% in 2023), indicating that while the demand is not high, there aren't too many vacant apartments either. Overall, more multifamily units are available in the market, but they are absorbed slowly, and rent increases are modest.

Retail Sales Los Angeles

Retail commercial data Los Angeles

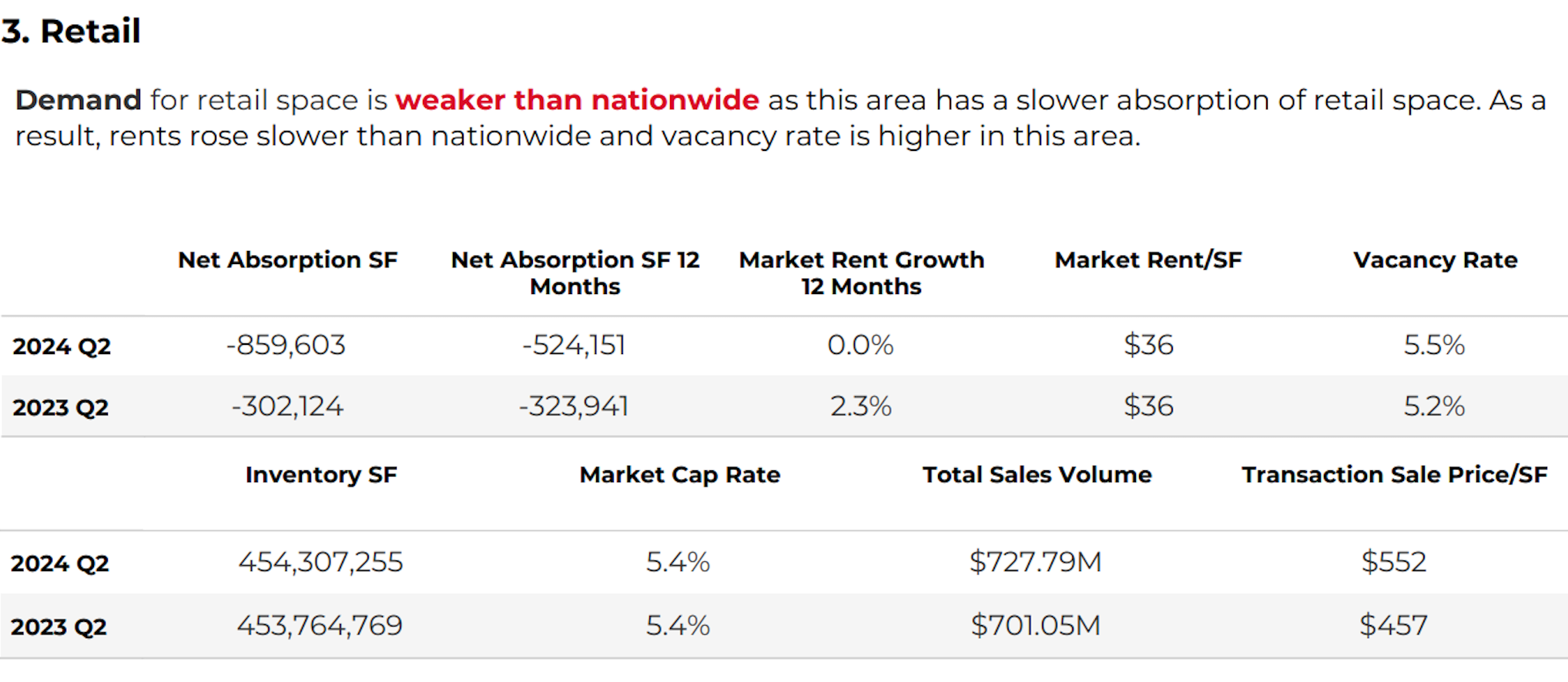

The demand for retail space in Los Angeles is weaker than in the rest of the country. In the second quarter of 2024, more space was left empty (-859,603 square feet) than in the same period last year (-302,124 square feet). Fewer businesses are moving in or expanding, leading to more vacant spaces. Over the past year, rent prices did not increase, unlike the 2.3% growth seen in 2023. The number of empty spaces also increased slightly, with the vacancy rate rising from 5.2% to 5.5%. However, even though demand is lower, the total value of sales for retail properties increased to $727.79 million in 2024, compared to $701.05 million in 2023, mainly because the price per square foot went up from $457 to $552. The market is seeing less demand, but the properties still sell at higher prices.

Industrial Space Los Angeles

Industrial Los Angeles Q2 2024 Data

The demand for industrial space (like warehouses and factories) in Los Angeles is also weaker than in other parts of the country. In the second quarter of 2024, more industrial space was left unoccupied (-3,276,028 square feet) compared to the same period in 2023 (-6,320,603 square feet). Over the past year, rents have actually gone down by 1.3%, while in 2023, rents had increased by 8.5%. The rent per square foot has stayed at $19 in both years.

Despite the weaker demand, there are fewer empty spaces (the vacancy rate rose from 3.8% in 2023 to 5.4% in 2024). The total sales volume for industrial properties decreased to $624.82 million in 2024 from $734.87 million in 2023. This means that even though there is less demand and the market is softer, industrial spaces are still being bought and sold, but at a lower rate than before.

Why Hire Us?

When it comes to commercial spaces, accurate data is everything. Up-to-date rental and market data are crucial for properly appraising your property and setting realistic expectations that lead to a successful outcome. If you're in the Los Angeles area and have a multifamily or commercial property to rent or sell, reach out for a complimentary, data-driven analysis.

We provide clear, actionable insights tailored to your property's unique situation, advising you every step of the way. You'll be informed and confident throughout the process, from the initial consultation to the final documentation and disclosures.

Don't leave your property's success to chance. Call today for the insights and guidance you need to maximize its value and achieve your goals.