2025 Los Angeles Housing Market Outlook

Holding Out for a Price Crash? Here’s the Reality

If you've heard that home prices are headed for a crash, it's essential to understand the current market conditions. While prices may vary across different regions, the data strongly suggests a crash is unlikely.

Back in 2008, an oversupply of homes flooded the market, dramatically dropping prices. Today, the situation is entirely different. There is a significant undersupply of homes for sale, which supports the stability of home prices.

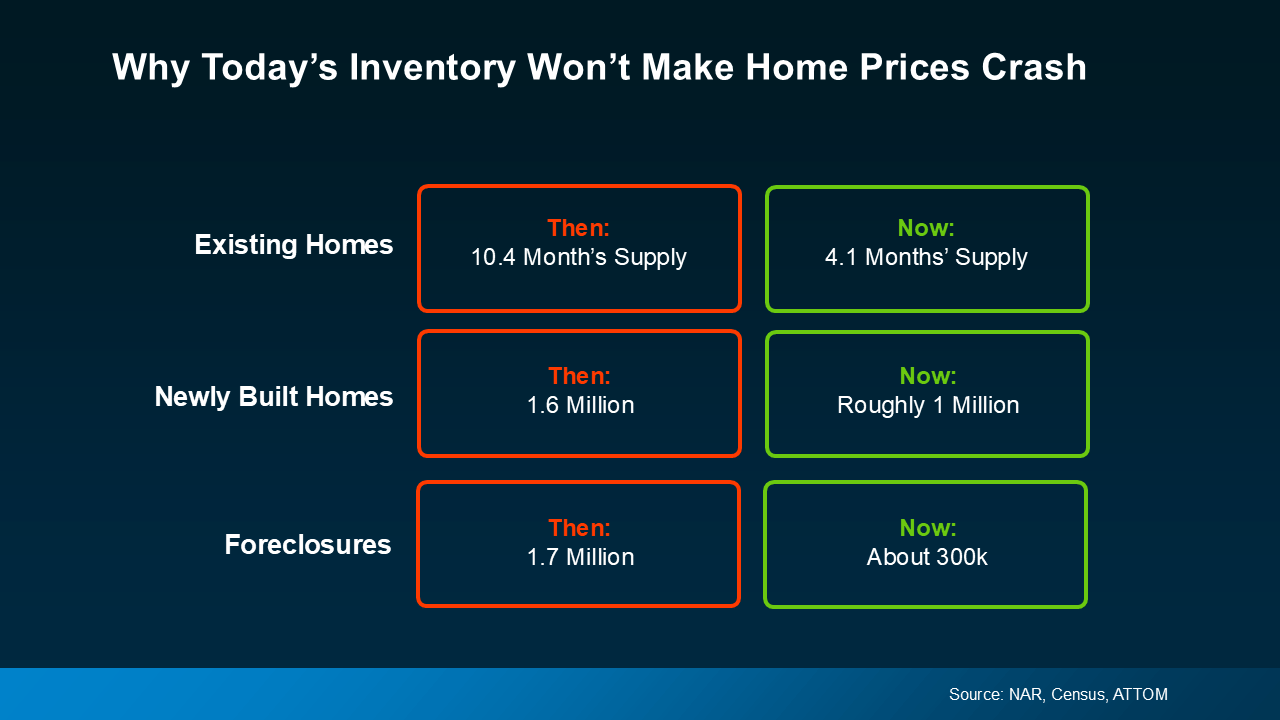

The chart highlights these critical differences between 2008 and current housing inventory and Activities:

2008 Housing Crash Versus Now, Supply is still low compared to the demand despite challenges.

Existing Homes Nationwide: Inventory has dropped from a 10.4-month supply in 2008 to just 4.1 months, well below the balanced 6-month supply.

Existing Homes Los Angeles-Inventory Levels Los Angeles: As of July 2024, 9,078 homes were for sale in Los Angeles, a 10.5% increase from June. The inventory supply in the larger Los Angeles Metro Area is 3.2 months. With just 3.2 months of supply, the Los Angeles housing market still has low inventory. Since economists view 4-6 months of supply as a balanced market, this shortage will likely continue driving home prices upward.

National Association Los Angeles Metro Data

Mortgage rates are expected to ease gradually over the next few months or even years, with the NAR projecting the 30-year fixed rate to average 6.5% by the end of the year. The Federal Reserve has three policy meetings left in 2024, and most economists predict a 0.25% rate cut in September as inflation eases and unemployment rises. However, affordability remains challenging due to high rates, limited housing supply, expensive home prices, and reduced purchasing power from inflation. While lower rates may help, these market pressures will continue to impact buyers and sellers alike.

Newly Built Homes U.S: The number of newly built homes has decreased from 1.6 million to roughly 1 million.

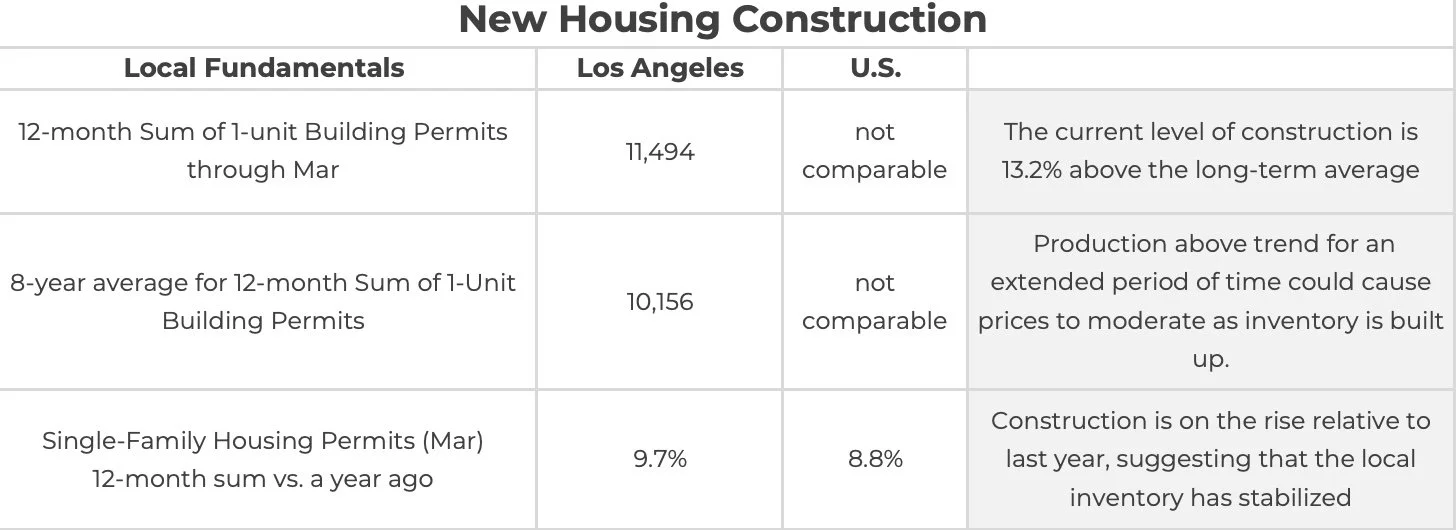

Newly Built Homes Los Angeles: Los Angeles is experiencing a surge in new housing construction, with 11,494 single-unit building permits issued over the past 12 months—13.2% above the long-term average. This uptick in building activity is well above the 8-year average of 10,156 permits, signaling a sustained trend of growth that could help moderate home prices as inventory builds up. With single-family housing permits increasing by 9.7% compared to last year, the market shows signs of stabilization, offering potential buyers more options and creating opportunities for investors in this thriving real estate environment.

Foreclosures U.S: Foreclosures have significantly reduced from 1.7 million to about 300,000 today.

Foreclosures Los Angeles: In July 2024, Los Angeles had 689 foreclosure properties per ATTOM data, a relatively low number for a city of its size. This suggests the foreclosure rate remains lower than in other large cities and below historical levels.

Los Angeles Housing Equity Gain

National Association of Relators Quarter 2 Data 2024

The median home price in Los Angeles for the first quarter of 2024 is $823,000, significantly higher than the national median of $385,100. Over the past year, Los Angeles has seen a 10.2% increase in home prices, compared to a 5.1% rise nationally. While the three-year appreciation rate in Los Angeles is 17.4%, slightly below the U.S. rate of 21.2%, local homeowners have still enjoyed substantial equity gains. In the past three years, the average homeowner in Los Angeles gained $122,000 in equity, compared to the national average of $67,467. Over seven years, this gain increased to $337,200 locally versus $154,400 nationwide, and over nine years, Los Angeles homeowners have seen an equity gain of $391,300, more than double the U.S. average of $181,700. This trend highlights strong home price growth in Los Angeles.

The Latest in Los Angeles Real Estate Market?

Lawrence Yun, Chief Economist at NAR, states:

“Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.”

Homes Are Taking Longer to Sell: With more homes on the market, homes aren't selling as quickly. Buyers have more time to decide, while sellers need to price their homes competitively to attract offers. Homes in Los Angeles are now selling in an average of 43 days, up from 37 days last year, but still relatively fast by historical standards. The market remains moderately competitive, though this varies from city to city within Los Angeles.

Fewer Offers for Sellers: Sellers might need to be more flexible on price or terms, while buyers face less competition with more options available.

Inspections Are Back on the Table: Buyers have more leverage, so fewer are waiving inspections. Sellers should be prepared to negotiate and address repair requests to keep deals moving forward.

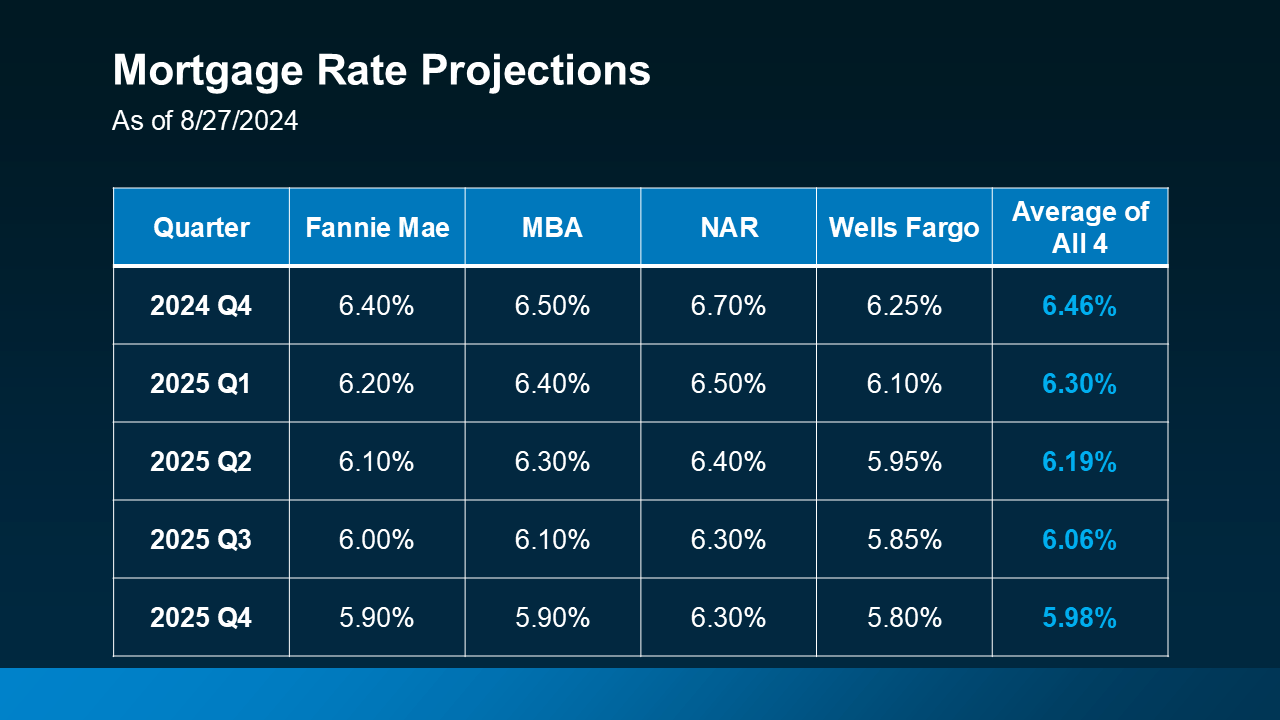

Mortgage Rates Quarter 4, 2024 and 2025 Forecast

Interest Rates 2025 Projections- Mortgage Rates 2025 Forecast

Mortgage rates are expected to decrease as easing inflation and a slight uptick in unemployment signal a strong yet slowing economy. Many experts believe these conditions will prompt the Federal Reserve to lower the Federal Funds Rate, which typically results in reduced mortgage rates.

With lower interest rates anticipated, mortgage rates are expected to ease later this year, improving affordability for homebuyers. The NAR projects the 30-year fixed mortgage rate to average 6.5% by the fourth quarter.

According to Freddie Mac, mortgage interest rates have declined for the second consecutive week, with the average 30-year fixed rate dropping from 6.46% on August 22 to 6.35% on August 29.

Odeta Kushi, deputy chief economist at First American Prediction: Rates will decline

“The anticipation of a Fed rate cut in September has largely been factored into existing mortgage rates. However, if incoming data is weaker than expected, implying more aggressive rate cuts, there could be additional downward pressure on mortgage rates. Conversely, if the data demonstrates economic resilience and labor market strength, rates may stabilize or even rise. Some week-to-week volatility is expected as investors adjust their expectations based on new information, but we should see the 10-year Treasury yield at least stabilize or continue on a downward trend, leading to a gradual decline in mortgage rates throughout the rest of the year.”

Senior economist at Realtor.com Ralph McLaughlin Prediction: Rates will moderate

“We expect mortgage rates to bounce around a bit over the next several weeks before falling to around the 6.4% mark by mid-to-late September. The short term volatility in rates will be due to expectations around the July PCE and August jobs report, but ultimately we expect rates to fall by 5-10 basis points as we approach the Fed meeting in September.”

The market is expected to see more homes available and increased demand as buyers and sellers re-enter due to easing rates, leading experts to project higher home sales next year.

Conclusion

With the Fed expected to cut interest rates in 2024, mortgage rates could ease, encouraging sidelined buyers and sellers to re-enter the market. This is projected to boost home sales, with experts forecasting a 2.6% national increase in home prices. While growth will be moderate, local market variations will play a key role.