September Real Estate Data

Housing Data Facts Will Alleviate Fear

The real estate market can be a source of anxiety and confusion for buyers and sellers, especially when mixed signals and conflicting data exist. Recently, the market has been subject to a rollercoaster of opinions and predictions, leaving many wondering where it's headed. Many individuals are currently uncertain as potential buyers and sellers in the real estate market. While they are ready, willing, and able to make a move, they are apprehensive about market conditions. Their concerns are based on sensational headlines and three prominent housing market fears.

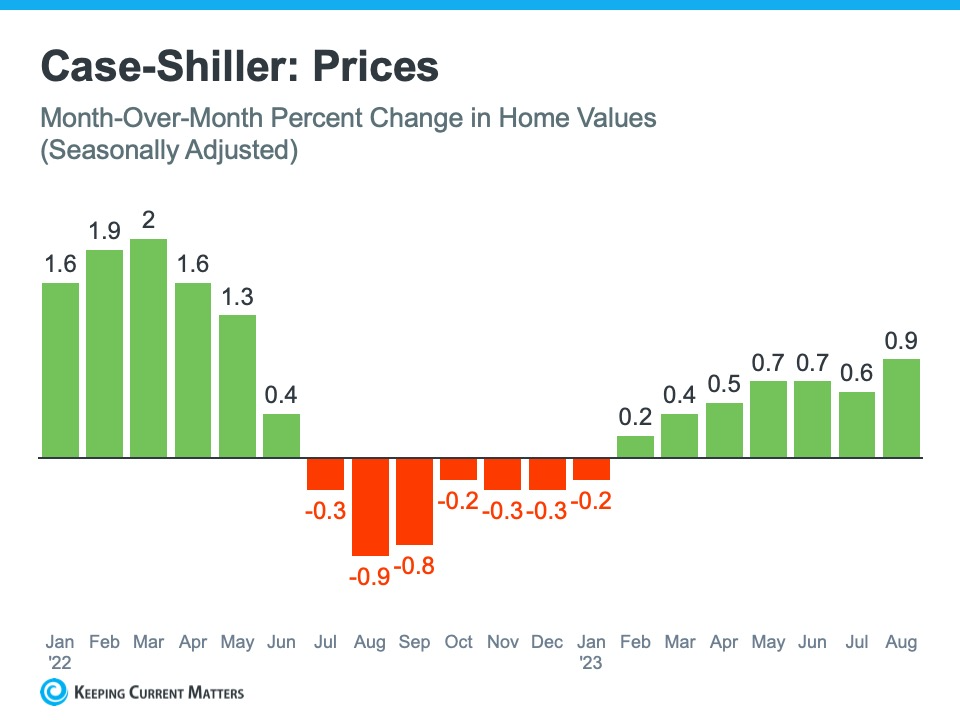

One of the prevailing fears among consumers is the belief that home prices will depreciate or even crash. However, recent data indicates that such a scenario is unlikely. Home prices have been resurgent, contrary to the typical trend of price deceleration in August and December. This trend has been observed in multiple housing price indexes, including Case Shiller and Freddie Mac's Home Price Index, which extends through September. While October data is pending, this re-acceleration of prices is notable.

This phenomenon is not an isolated occurrence but rather a consistent trend. Black Knight reports that home price growth has increased for two consecutive months in all 50 US markets, mirroring the national-level re-acceleration.

From Black Knight’s November Mortgage Report (covering September numbers):

“On one hand, prices rose 0.39% to yet another all-time high on a seasonally adjusted basis, further accelerating the annual home price growth rate to +4.3%, up from a revised +3.7% in August…On the other hand, September's seasonally adjusted rise was the weakest since January and a noticeable downshift from August.”

Conflicting Reports on Price Trends

One of the primary sources of confusion in the market is the differing opinions on the direction of housing prices. Some reports suggest that prices are skyrocketing, while others indicate a slowdown or depreciation. Let's take a closer look at these conflicting perspectives.

Reacceleration of Prices

Some major housing price indexes have been pointing to a reacceleration of house price appreciation. This means prices continue to rise rapidly, which can concern potential buyers. Factors like limited housing supply and high demand have contributed to this trend. However, this doesn't necessarily mean prices spiral out of control.

Depreciation or Slowing Growth

On the other hand, Zillow, a prominent real estate data provider, has reported a minor depreciation in home prices for specific months. This contrasting view has added to the uncertainty in the market. Understanding that these fluctuations might not signify a long-term trend is crucial.

From Zillow this morning:

“A 0.3% monthly decline in values in October is a tad steeper than the 0.1% dip from August to September and shows a slightly faster deceleration than pre-pandemic norms.

Understanding the Affordability Equation

Affordability is the key factor that often drives decisions in the real estate market. Buyers and sellers are both affected by the perceived affordability of homes. Affordability isn't just about the sticker price of a house; it involves various financial considerations, including mortgage rates, equity buildup, and more.

For those ready and able to buy a home, the question of affordability is paramount. Rising mortgage rates can make buying a home more expensive, and when combined with rapidly appreciating home prices, it can deter potential buyers. However, consider the long-term benefits of homeownership, such as building equity over time.

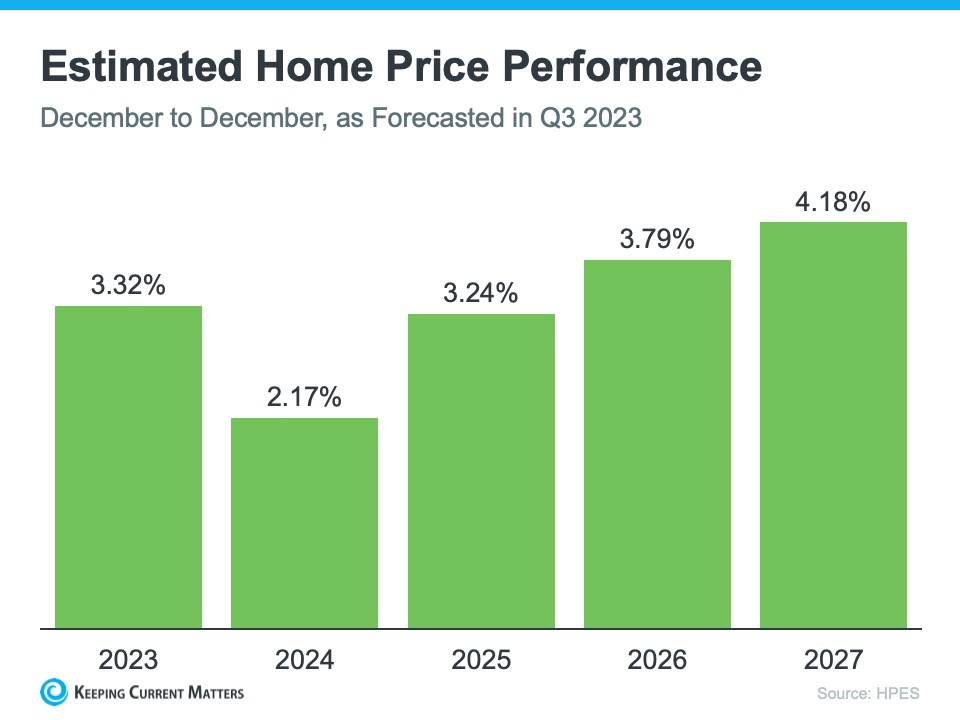

Expert Opinions on Future Price Trends

To gain insight into where the housing market is headed, experts frequently turn to forecasts from economists, real estate experts, and market strategists. These professionals are surveyed regularly to gauge their predictions for future price trends. The latest survey results suggest that while price appreciation may not reach the levels seen in recent years, it is expected to continue more moderately.

Taking the Fear Out of the Market

Fear and uncertainty can lead to hesitation in the real estate market. It's natural to be concerned about making such a significant financial decision, especially when there's conflicting information. However, the housing market is cyclical, and short-term fluctuations are common.

The key to navigating the real estate market is to stay informed and seek guidance from professionals who understand the nuances of your specific location and circumstances. While some reports may highlight anomalies or short-term trends, looking at the bigger picture and considering your long-term goals is essential.

It's not about dismissing concerns with overly optimistic assurances but offering realistic perspectives and informed advice.

Slow Appreciation, Not Falling Prices

One common misconception is that experts predict a sudden drop in housing prices over the next five years. However, the reality is quite different. A consensus among a hundred experts in the field suggests that prices are expected to appreciate, albeit much slower than in previous years.

This forecast of slow appreciation provides a sense of calm for those in the market. Many people buy or sell homes not solely for financial gain but because of life events or changes in their circumstances. They're not banking on rapid price increases; they have other compelling reasons for their real estate decisions.

The Changing Motivations for Buying

In the past, the housing market was often seen as a pathway to quick financial gains. Buyers anticipated substantial year-over-year price increases, making homeownership an attractive investment. However, times have changed, and the era of double-digit price growth may be behind us.

Today, buyers are motivated by a variety of factors beyond monetary considerations. Life events like marriage, having children, job relocations, or downsizing often drive buying or selling a home. These personal and lifestyle choices aren't solely dependent on market conditions.

Conclusion:

For buyers and sellers, the key is to focus on their specific needs and goals. If you're buying a home because it aligns with your life plans, the speed of price growth becomes less significant. Likewise, sellers should consider their circumstances and the current market conditions when determining the right time to sell.

The real estate market is shifting, and steady appreciation is becoming the norm. This change should not be a cause for fear but an opportunity to make real estate decisions based on personal needs and objectives. While market conditions will always play a role, a well-informed approach guided by your circumstances can lead to a successful and satisfying real estate experience.