Real Estate Guide for Retirees in Los Angeles

Selling Your Home in Retirement In Los Angeles, California

When contemplating selling your home after retirement, weighing various factors is crucial. Offloading your property might bring a considerable cash boost and eliminate ongoing expenses like mortgage payments, property taxes, insurance, and upkeep. Conversely, retaining your home could be financially prudent, mainly if it's mortgage-free or qualifies for capital gains tax exemptions. Moreover, selling and renting during retirement can reduce maintenance responsibilities, enhance independence, and decrease overall living expenses.

Should I Sell My Home Or Not After I Retire In Los Angeles?

Before deciding to sell your home in retirement, it's crucial to understand its value, the state of the housing market, and the readiness of your property for sale. These factors will significantly influence your decision and the financial outcome of a sale. Start by asking yourself a few key questions:

How much is your home worth?

What is the remaining mortgage balance?

What is the current state of the real estate market?

What is the condition of your home?

What is your timeline for selling?

Do you need to sell?

is the house too big for my needs?

How much will it cost to customize?

Understanding these elements will provide a clearer picture of whether selling is the right financial move.

The Advantages of Keeping Your Home in Retirement

Retaining Home Ownership After Retirement

For some retirees, keeping the home and securing a reverse mortgage might be more appealing. This allows for an income stream to cover monthly expenses or unexpected costs without having to leave your cherished home. The choice between selling and staying put depends on your financial situation, emotional attachment to your home, and plans.

Realizing Potential Savings

The financial benefits of staying in a paid-off or nearly paid-off home are significant for many retirees. If your mortgage is fully paid, you might enjoy the luxury of no monthly payments, a benefit that can make a substantial difference in your retirement budget. Here's why keeping your home might be a wise decision:

No Monthly Mortgage Payments: For those who have paid off their mortgage, the absence of monthly payments can free up substantial funds.

Tax Benefits: Homeownership offers tax advantages, such as deducting property taxes. 2023, for example, married couples filing jointly can deduct up to $10,000 in property taxes from their federal income tax. Additionally, the money received from a reverse mortgage is tax-free. On the other hand, rent payments do not qualify for tax deductions.

Stable Monthly Payments: If you still have a mortgage, your payments are typically fixed and predictable, unlike rent, which can increase over time.

Leaving a Legacy

Your home is more than just a financial asset; it's a part of your legacy. Leaving your property to your successors can give them a substantial asset, often with a favorable tax basis. This inheritance can be a meaningful gift to the next generation.

Accessing Equity Through Reverse Mortgages

A reverse mortgage allows you to tap into your home's equity, converting it into cash flow. This can be an invaluable source of income in retirement, helping to cover monthly bills and medical expenses or to provide a more comfortable living. Notably, the income from a reverse mortgage is not taxable, adding to its appeal.

Customization and Comfort

Owning your home allows you to modify and customize your living space to suit your retirement needs. Whether installing safety features, remodeling for accessibility, or simply updating the decor to your taste, homeownership allows personalization to enhance your quality of life significantly.

Stability and Security

Homeownership in retirement offers a sense of stability and security that is invaluable. Your home can be a familiar, comfortable place where memories are cherished, and new ones are made. It's a place of community, continuity, and personal history.

The Pros of Selling Your Home After Retirement in Los Angeles

Selling your home upon retirement can open up various opportunities and alleviate certain burdens. Here are some potential benefits:

Surge of Capital: Selling your home can provide a substantial sum that can be used to cover living expenses, invest, or enjoy life's pleasures.

Reduced Responsibilities: Without a home, you no longer face mortgage payments, property taxes, or maintenance costs.

Lifestyle Flexibility: Selling might allow you to downsize, relocate to a more affordable area, or live closer to family.

Safety Considerations: A new home can mean fewer stairs and a layout better suited to your mobility needs.

Leveraging Home Equity for Your Next Chapter

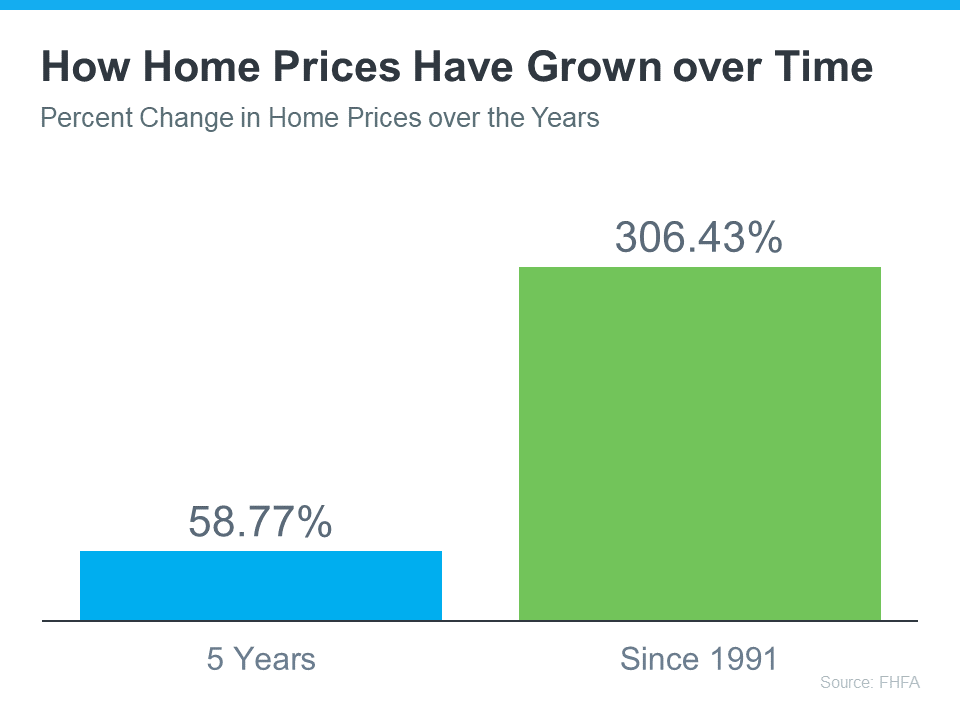

Whether you aim to downsize, move to your ideal locale, or want to live nearer to family, the equity in your home can be instrumental in achieving your goals. Moreover, the longer you've resided in your home, the more equity you've likely accumulated, thanks to years of property value appreciation. This built-up equity can significantly support your next residential move.

Financial Implications: Taxes and Expenses

When selling your home, you must know about potential capital gains taxes. Capital gains tax laws permit individual taxpayers to exclude up to $250,000 of capital gains on their returns. For married couples filing jointly, the exclusion amount doubles as much as $500,000 of profit. A careful calculation is necessary to ensure that selling your home supports your financial and lifestyle goals. Please consult your accountant about your options.

Understanding Proposition 19 in California

If you're over 55, affected by fire or flooding, or have a disability, you may be eligible for the benefits of Proposition 19.

Transferring Property Tax Base

If you're over 55, disabled, or have been affected by a wildfire or natural disaster, you can move and take your current low property tax to a ew primaryn home. This can be done thrice (or once per disaster). You can buy or build a new home anywhere in California and still benefit from this rule.

Property Inheritance and Home Transfer to Your Children

Proposition 19 changes how inherited homes are taxed. Before, when parents passed down home to their children, the property tax could remain very low. Now, under Proposition 19, this is still possible, but with conditions:

The home must have been the primary home of the parent(s).

The children must also use the inherited home as their primary home within one year of receiving it.

If you inherit your family home, you can keep the lower taxes only if you live there as your main home.

Conclusion

Selling your retirement home is a significant decision that requires a thorough evaluation of your financial situation, personal needs, and market conditions. Whether you enjoy the equity you've built in your home, downsize for a simpler lifestyle, or relocate for retirement, each path offers unique advantages and considerations. Reflect on your long-term goals, consult with financial advisors, and make the choice that best suits your vision for retirement. If you decide to sell your home, contact us for a complimentary home evaluation, appraisal, and consultation.