Resilience in Real Estate: Navigating Market Fluctuations and Building Wealth

Will Housing Market Crash In Los Angeles?

The housing market buzzed with doomsday predictions as mortgage rates spiked to 8% in October. Many feared this surge would decimate buyer demand, signaling a catastrophic downturn. Yet, it's essential to understand that panic is a poor strategist. Fast forward to today, with rates adjusted back to 6.6%, and it's clear that the October panic was premature as usual. It is easy to panic when you don’t have all the facts, historical data, and market conditions. But what does this fluctuation mean for the housing market?

Historical Insights and the Resilience of the Housing Market

History is a rich repository of lessons, particularly evident in the housing market's resilience. Back in 2008, a year many feared would mark the end of homeownership, pushing us towards a predominantly renter-based society. Yet, this bleak prediction did not materialize. Fast forward to 2020, amidst the chaos of a global pandemic, when dire forecasts dominated headlines. Contrary to expectations, the market experienced an unprecedented surge in demand, leading to multiple offers and homes selling well above the asking price, often with minimal or no contingencies.

This trend of defying gloomy predictions for housing continued into 2022. When mortgage rates climbed to 5% in April, many predicted buyer demand would diminish, followed by increases to 6%, 7%, and even 7.5%; many predicted a housing crash. With each instance and rate hike, the clamor of doomsday predictions and panic grew increasingly louder and more fervent. However, despite the challenges, the market proved strong and showed that buyers are as eager as ever to own their real estate; as our population increases and our ways of living change, people will continue to need homes.

Why is inventory persistently low?

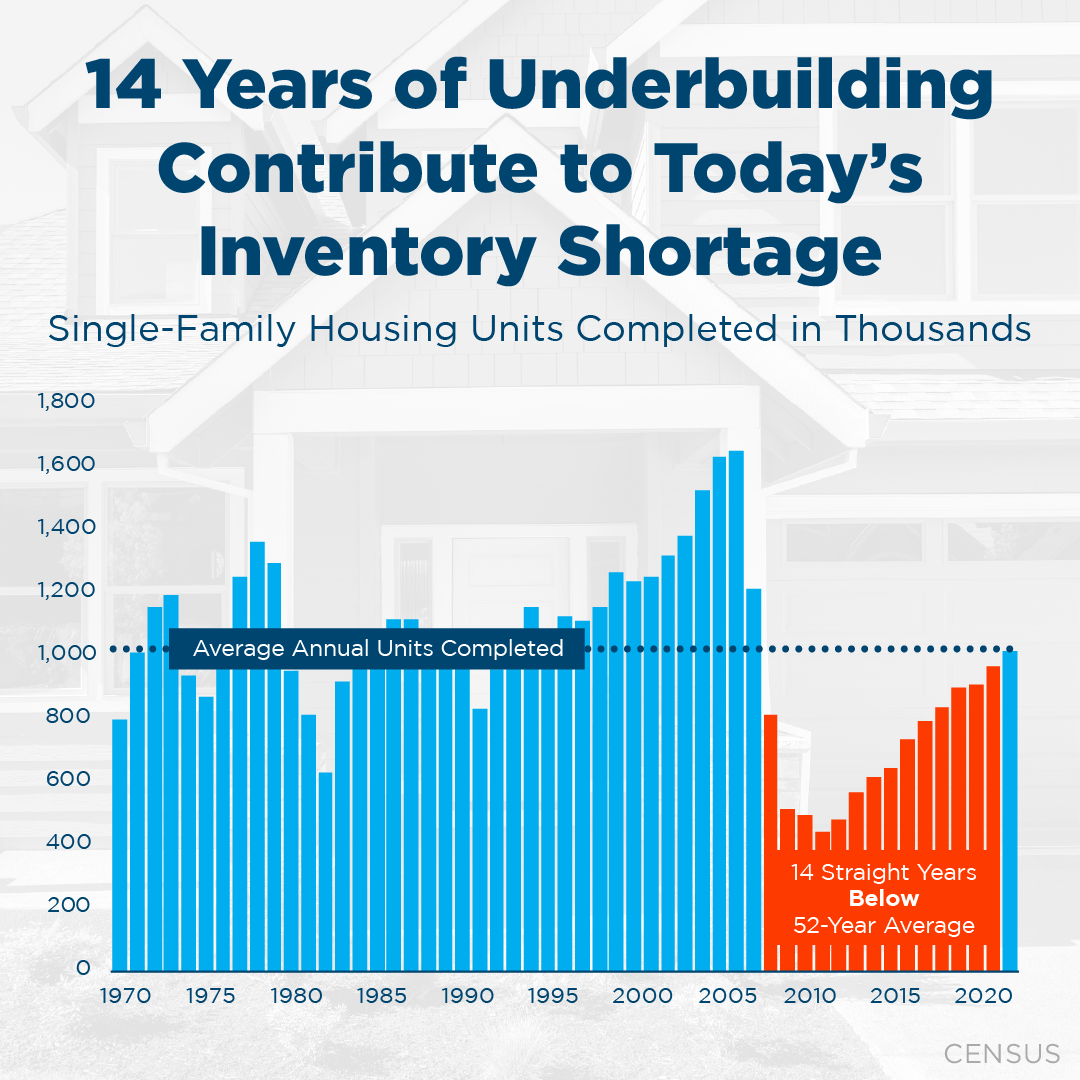

A primary factor is that builders haven't kept pace with the need for new homes for over a decade. Additionally, many homeowners are reluctant to sell because they've locked in historically low mortgage rates of around 4% or lower. Although there's been an uptick in new home construction recently, rectifying the shortage will take time and won't be resolved immediately. We have been underbuilding, and the demand has been robust; thus, the prices have increased. Through its ups and downs, the housing market shows it's not just about money and interest rates; it's about our basic need for a safe, secure place to live and be part of a community

Life Happens, And So Do Our Housing Needs

Consider the inevitable life events that drive housing transactions: a widow or widower passes, leaving home to sell; a couple expecting twins outgrow their one-bedroom condo; a startling affair leads to two homes on the market; or a job relocation necessitates a quick sale. These are the personal stories behind each transaction, the human side of the housing market that continues regardless of rate hikes or economic downturns. Life changes, and so do our housing needs. Transactions will happen, life will go on, and homes will continue to be a central part of our stories.

While forecasters may lean towards alarm, our duty as real estate professionals is to ground our guidance in facts and navigate the public through the market's fluctuations with education, assistance, and reassurance. Indeed, the affordability challenge is significant, yet it's far from impossible. Remarkably, over 10,000 homes change hands daily, a testament to the persistent and real need for housing. This figure could further increase with an uptick in available inventory. The demand for homes is not just a number; it reflects the essential role housing plays in our lives.

Generational Wealth Through Real Estate In Los Angeles

Every parent dreams of setting up their children and grandchildren for a life that's healthier, happier, and more affluent. Building generational wealth, or passing down money and assets to descendants, is a crucial part of this vision, with property often playing a significant role.

Real estate often represents one of an individual's most substantial assets. As this asset appreciates over time, it can yield considerable gains. Wisely leveraging these profits can substantially enhance the financial well-being of future generations. Purchasing and owning a home is a crucial strategy for creating generational wealth. As you gradually pay off your mortgage and your property's value increases, home equity can substantially grow, providing a valuable asset for future generations.

Based on a Gallup poll, for 11 consecutive years, individuals have consistently rated real estate as a superior investment compared to bonds, stocks, and gold.

Conclusion

Understanding market dynamics is key to making informed decisions in the ever-evolving real estate landscape. Despite the periodic panic and doomsday predictions, the housing market's resilience continues to be evident. History has repeatedly shown us that housing is not just a financial asset but a fundamental human need. With the proper knowledge and perspective, individuals can navigate the ups and downs of the market, finding opportunities for investment and stability in homeownership.

If you're in the Los Angeles area and seeking a listing or buyer's agent for your real estate endeavors, our team is ready to support you. We're here to understand your needs, gather information, and provide education so you can make the best choices for you and your family.