Income Properties Los Angeles

Latest Data Multifamily Sector

In 2023, as mortgage rates climbed above 7.5%, there was a resurgence in the demand for apartments within the multifamily sector during the latter half of the year after experiencing almost a year of diminished activity. Despite this increased interest, the ongoing surge in construction led to a rise in vacancy rates, which peaked at 7.4%, decelerating the rent growth to a mere 0.6% by year-end. Yet, despite this slowdown, rents continued to escalate from the prior year's figures, According to NAR National Association of Realtors research.

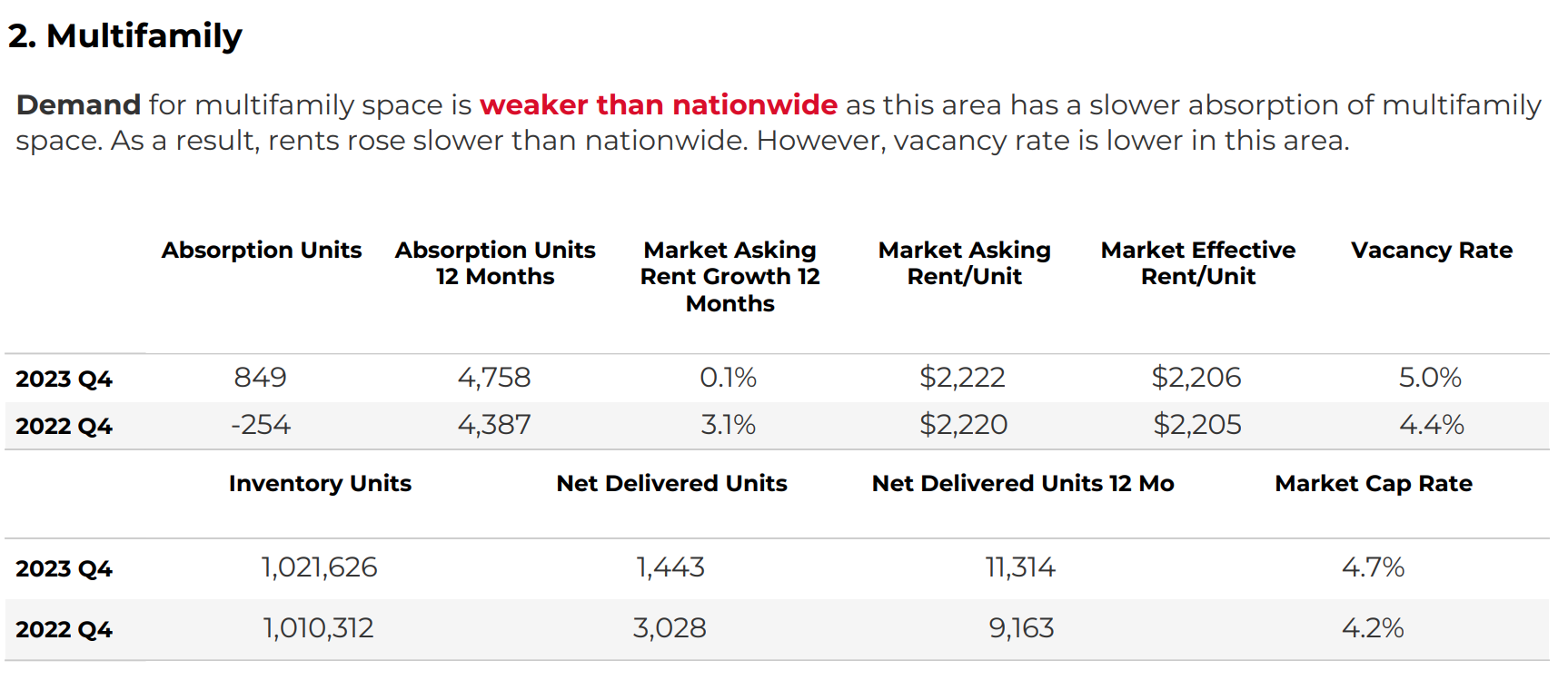

Multifamily Investment Data in Los Angeles Q4 National Association of Realtors-NAR- Data

Is This A Good Time to Invest in Multifamily?

This week, the average rate for a 30-year fixed mortgage rose to 6.77%, an increase from last week's 6.64%, according to data from Freddie Mac. Despite the recent weekly upticks in mortgage interest rates, their general trend since fall 2023 has been downward, standing a full percentage point lower than the recent peak. Although mortgage interest rates might decrease to the low 6% range in the mid to latter part of the year, prospective buyers must carefully consider their options, especially as real estate prices are likely to rise due to the constrained inventory.

Looking ahead to 2024, the commercial real estate landscape is set to experience a more promising period following a challenging 2023, characterized by rising vacancy rates and slowing rent increases. The forthcoming year brings optimism despite ongoing market challenges, as lower interest rates are expected to alleviate some of the prevailing headwinds.

Benefits of Investing In Multi-units, Commercial Properties in Los Angeles

Investing in multifamily properties in Los Angeles presents many advantages, appealing to a broad spectrum of real estate investors. Here are some key benefits:

High Demand and Market Stability: The city's vibrant entertainment and tech industries and iconic status draw a diverse population, ensuring a robust demand for rental units. This demand, coupled with Los Angeles' resilience in the real estate market and a significant renter population, positions multifamily investments as highly attractive.

Advantageous Demographics and Scarcity of Land: Los Angeles' demographics favor multifamily investments, with limited available land and high entry barriers safeguarding investment value through various market phases. Despite lower capitalization rates, the intrinsic value of land in Los Angeles surpasses that of many other regions.

Reduced Vacancy Risks and Operational Savings: Multifamily units in Los Angeles offer lower vacancies, ensuring a steady income flow and substantial equity build due to stable population growth, liquidity, and opportunities, ensuring steadiness and stability.

Financial Incentives and Tax Deductions: The stable cash flow from multifamily properties, driven by multiple income-generating units, along with significant tax benefits such as deductions for mortgage interest, maintenance, property management, and depreciation, enhances the investment appeal.

Cons of Investing in Multifamily in Los Angeles

Factors like rent control, higher interest rates to justify the cap rates, seismic retrofitting, Mansion tax Measure GS, and various other challenges have led some investors to look for investment opportunities in states with more favorable conditions for landlords. Yet, the interest in acquiring apartment properties in the greater Los Angeles area remains strong. Despite challenges, buyers and renters find themselves in a competitive market with rising property prices. This robust demand persists despite reports and news of a declining population and a significant departure of residents from California.

Why Will the Los Angeles Multifamily Market Experience Appreciation?

In the decade leading up to COVID, America significantly fell short in housing and multifamily production, a deficit that continues to affect the market. The solution is encouraging construction, yet specific local policies exacerbate the problem. Measures like rent control, NIMBY (Not In My Back Yard) attitudes, and increased impact fees are misguided approaches that will only deepen the housing and multifamily shortage, increase rent prices, and elevate housing costs and multi-unit appreciation over time.

What to Know About Rent Control in Los Angeles When Investing in Multifamily?

Each city implements its rent control laws and regulations; becoming acquainted with these before purchasing a multifamily property can significantly reduce potential headaches. Moreover, recent state legislation has established caps on annual rent increases for tenants across California. These provisions also grant tenants a certain level of protection against eviction and ensure they are entitled to compensation should they need to leave their apartments. Rent control policies are implemented in the LA region's unincorporated areas of Los Angeles County and the cities of Culver City, Inglewood, Los Angeles, Santa Monica, and West Hollywood.

City of Los Angeles Rent Control: Rent control applies only to buildings constructed and occupied before October 1, 1978. Much more stringent than the State rent control regulations, the rent cap is lower, and the buildings are older.

California State Rent Control: Applies to buildings built after 1978. In California, statewide rent control is regulated under the California Tenant Protection Act, or AB 1482, effective January 1, 2020. This legislation caps yearly rent increases at 5% plus the local inflation rate for units not already subject to local rent control laws. Local rent control statutes can override the state's regulations. Several of California's largest cities enforce their rent control policies, offering extra protections for tenants. Thus, while AB 1482 sets a foundational standard for rent control across the state, tenants may find more extensive protections and restrictions within local ordinances.

AB 1482, known as the Tenant Protection Act of 2019, is a California state law that addresses affordability and tenant stability issues in the rental housing market. Enacted to provide statewide rent control and eviction protections, AB 1482 imposes several regulations and gives the tenants more protection.

What Is The Costa-Hawkins Rental Housing Act?

The Costa-Hawkins Rental Housing Act in California 1995 sets local rent control laws boundaries. It introduces two key provisions:

Exemptions from Rent Control: This excludes specific residential properties from rent control, such as single-family homes, condos, and newly built apartment complexes, effectively removing them from the constraints of local rent control regulations.

Vacancy Control Prohibition: The Act disallows "vacancy control." This ensures that you can rent the unit at market rate once the tenants move out.

Happier Times for Landlords: Before California's Statewide Rent Control Tightened

Before the enactment of AB 1482, California lacked a uniform policy on rent hikes for multifamily units built after 1978, and landlords throughout California, including those in Los Angeles, landlords could have ended a tenancy by giving 60 days' notice without specifying a cause. Additionally, the Costa-Hawkins Rental Housing Act stipulated that residential units constructed after February 1, 1995, could not have their annual rent increases capped. This changed significantly with the implementation of AB 1482 on January 1, 2020, which introduced a statewide restriction on rent increases. This law now limits yearly rent hikes to 5% plus the inflation rate in areas not governed by local rent control laws. Consequently, many landlords, who previously enjoyed greater flexibility in setting rent prices, opted to sell their properties and exit the California market. Accustomed to certain profit margins that were no longer attainable under the new regulations, landlords were compelled to reassess their investments in the state.

Bottom Line:

It's crucial to understand that rent control laws and regulations can vary significantly from city to city, as well as from state to state. Often, city ordinances may take precedence over state laws. We are not legal professionals, so it's essential to conduct thorough research into the most current rent control laws and regulations before purchasing multifamily or commercial property in Los Angeles and its surrounding areas. Our role is to provide relevant information to help you make your decision. If you're contemplating the sale of your multifamily properties in Los Angeles, looking to liquidate your assets, or considering a portfolio sale, we're here to help. Conversely, if you want to invest in Los Angeles and seek detailed insights into the market, including what factors to consider, we're ready to offer our assistance.