Why the Current Housing Market Is Not on the Verge of a Crash

Key Difference Between 2008 and Today's Housing Market

The year 2008 is etched in the minds of many homeowners who witnessed their properties lose their value almost overnight. The housing market crashed, leading to foreclosures and defaults. However, the current housing market is different from the past. Today's market has several factors that set it apart from the conditions that led to the 2008 crisis.

Getting a Mortgage is Harder

First, securing a loan has become more challenging, and mortgage companies have set higher lending standards, making getting a loan harder. During the 2008 housing bubble, the lax lending standards led to a subprime mortgage crisis, where many homeowners could not afford their homes, leading to foreclosures and defaults. Lenders in the past provided mortgages to individuals irrespective of their credit history or down payment size. In contrast, today, lenders have stringent standards, and most of those obtaining a mortgage have excellent credit. According to a recent report by the Urban Institute, mortgage delinquencies are currently at their lowest point in the past 20 years, highlighting the success of the more stringent lending standards today.

Builders Are Still Catching Up to Pre-Crisis Levels

After the 2008 housing crisis, homebuilders significantly reduced their building activity and never fully resumed pre-crisis levels. Consequently, the demand for homes far outweighs the supply, and builders need help acquiring land and regulatory approvals quickly enough to meet the demand. Despite building as much as possible, it is unlikely that there will be a repeat of the overbuilding that happened 15 years ago. The current surge in home prices results from high demand and low supply in the housing market. To tackle this issue, cities can incentivize builders by relaxing zoning rules, regulations, and other constraints, thereby allowing them to construct more affordable homes and meet the growing demand.

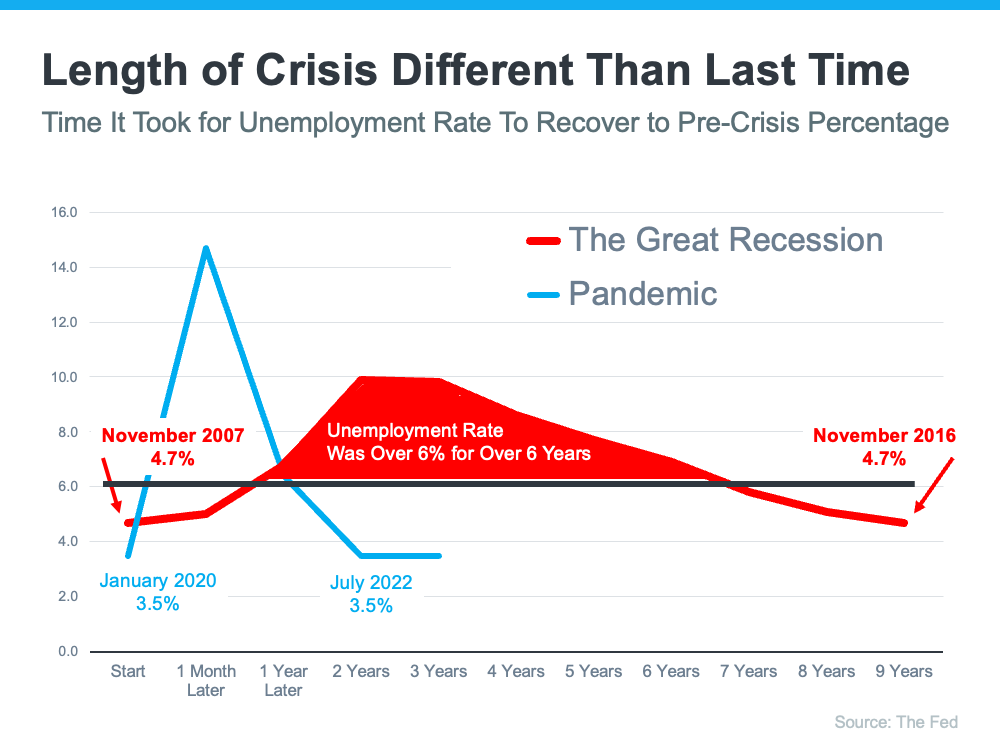

The Resilience of the Labor Market: How Today's Unemployment Levels Compare to 2008

Second, unemployment levels have returned to pre-pandemic levels. In contrast, the Great Recession of 2008 resulted in prolonged high unemployment levels. Today's housing market is not facing a similar problem, with the jobless rate already at pre-pandemic levels. There is a significant contrast between the current unemployment numbers, fluctuating between 3.4 percent to 3.7 percent since March 2022, and the much higher unemployment rates during the recession period, with a peak of 10.0 percent in October 2009.

Demographics Drive Demand

The current housing market is experiencing high demand from multiple fronts thanks to various demographic trends. Millennials and Hispanics are significant demographic groups transforming the housing market, and their interest in becoming homeowners is one of the factors driving up home prices.

Inventory Levels are Still Stubbornly Low

Third, there is a need for more available inventory in today's housing market. This differs from the abundance of inventory in the market leading to the 2008 crisis. The low inventory is due to years of underbuilding homes, resulting in demand that outstrips supply. The National Association of Realtors (NAR) reported that the current supply of homes for sale is 2.6 months, far below the six-month level considered a balanced market.

People Have Accumulated Equity

Finally, homeowners today have near-record amounts of equity due to the upward pressure on home prices caused by the low inventory of homes for sale. According to CoreLogic, home equity rose by $1.5 trillion in the first half of 2021, with an average gain of $33,400 per homeowner. This positive development provides homeowners with financial security, as their homes are worth more than they owe on their mortgages.

People have tremendous equity

Foreclosure Activity is Low

During the years after the housing market crash, the housing industry experienced a deluge of foreclosures, leading to an oversupply of homes. The vast number of foreclosures flooded the market, and as a result, home prices sharply declined, leading to depressed prices. The situation is quite different now, with foreclosure activity being relatively low. The housing market is experiencing an inventory shortage, with demand significantly exceeding supply. The low levels of foreclosure activity have prevented a surge in inventory, thereby maintaining the current price levels. The government's forbearance program implemented during the pandemic has effectively prevented an increase in foreclosure activity. Additionally, the substantial equity accumulated by homeowners has also contributed to keeping foreclosed properties off the market.

Principal Economist at CoreLogic explains:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases have given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

Bottom Line

In conclusion, the current housing market is not a repeat of the 2008 housing crisis. Mortgage companies have set higher lending standards, unemployment rates have returned to pre-pandemic levels, there is a shortage of available inventory, and homeowners have near-record amounts of equity. These factors provide homeowners with a measure of financial security, highlighting the stability of the current housing market.