Home Prices, Where Are They Headed?

If you're keeping up with today's news, you might be uncertain about the fluctuations in house prices, worried about whether the worst is still ahead. This uncertainty is fed by the pessimistic portrayal of the situation in today's headlines. Looking at the year-over-year data, there was indeed a slight dip in home prices. But this is when we're juxtaposing it with an extraordinary year when prices unexpectedly soared beyond average values.

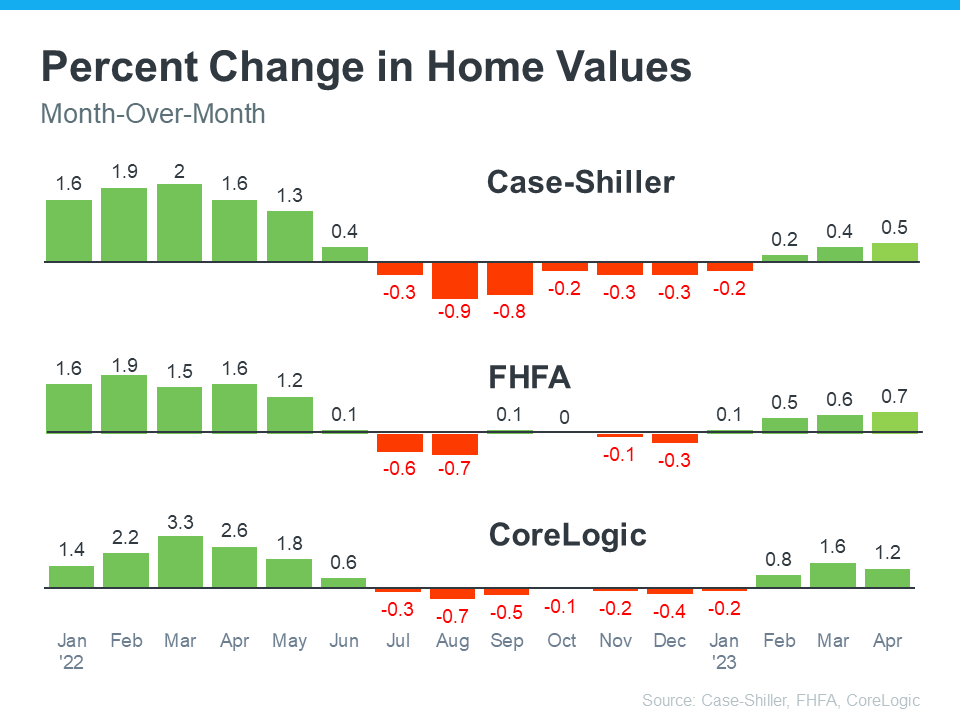

We ought to analyze the monthly figures to bypass this skewed comparison with the previous high point. These present a contrasting and considerably more optimistic narrative. Although the trends in local home prices continue to differ depending on the market, the nationwide data offers us some insights.

What Are Top Chief Economists Saying About the Current Real Estate Market?

Craig J. Lazzara, Managing Director at S&P Dow Jones Indices, confirmed in his statement on June 27, when the latest data were made public,

“The U.S. housing market continued to strengthen in April 2023.” He added, “Home prices peaked in June 2022, declined until January 2023, and then began to recover.”

Mark Fleming, Chief Economist at First American, puts it this way; How more demand than supply keeps upward pressure on prices:

“History has shown that higher rates may take the steam out of rising prices, but it doesn’t cause them to collapse entirely. This is especially true in today’s housing market, where the demand for homes continues to outpace supply, keeping the pressure on house prices.”

Doug Duncan, Senior VP and Chief Economist at Fannie Mae; Home price growth is exceeding expectations thanks to that high demand:

“. . . housing prices continue to show stronger growth than what was previously expected . . . Housing’s performance is a testimony to the strength of demographic-related demand . . .”

Indeed, there was a slight decrease in home values compared to April 2022, but it was an inconsequential 0.2 percent. Even though the housing boom may have hit a plateau, it's important to note that this doesn't herald a real estate market crash. Instead, it's a temporary pause - a far cry from a catastrophic downturn.

Rick Arvielo, head of the mortgage firm New American Funding;

“The resurgence of bidding wars and a persistently tight inventory are once again the order of the day.” "There’s just not enough inventory.” And he adds, "You’re not going to see house prices decline.

Skylar Olsen, the Chief Economist at Zillow, concurs with the perspective on the supply-demand mismatch. Her most recent predictions say, “We can expect home prices to continue upward until 2024 - a promising outlook for home sellers but challenging for first-time buyers striving to secure a foothold in the housing market.” also, she adds, “We’re not in that space where things are suddenly going to be more affordable.”

Why Housing Crash Unlikely

In May, the housing inventory could only cater for a 3-month supply, considerably short of the 5 to 6 months supply required for a well-balanced and healthy market.

A clear distinction between the current situation and the Great Recession of 2008 lies in the vastly improved personal financial status of homeowners today compared to 15 years ago. Most homeowners with mortgages today possess excellent credit and significant home equity and have secured fixed-rate mortgages at considerably less than 5 percent. As a June study by Redfin indicates, an overwhelming 82.4 percent of all current homeowners have their rates fixed below the 5 percent threshold.

In addition, the Great Recession has left an indelible mark on builders, making them vigilant about the rate of their construction activities. Consequently, there need to be more homes available for sale.

Lawrence Yun, the chief economist at the National Association of Realtors, puts it this way": "We simply don’t have enough inventory," and "Yes," some markets might witness a price drop. However, he adds, “With the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

Odeta Kushi, an economist at First American, states, “The year-over-year comparison misleadingly suggests prices are falling, but that is all in the rear-view mirror. The short supply along with continued demand for homeownership are driving prices higher again.”

What is Ahead?

Jiayi Xu, Economist of Realtor.com:

“This week’s encouraging inflation data could be a basis for another ‘wait-and-see’ approach in the upcoming FOMC meeting, which may help reverse the recent rise in mortgage rates. This, in turn, would create a more favorable environment for those looking to purchase a home in the coming fall season.”

Home Seller Hesitation

The primary obstacle contributing to the inventory shortfall is a phenomenon referred to as "rate lock." Many homeowners are locked into such low mortgage rates on their existing homes that the prospect of relinquishing them becomes daunting, especially given that the rates on their next purchase would likely be significantly higher.

Conclusion

This is a simple economic issue: demand exceeds supply, with more prospective homeowners than sellers. However, a silver lining for buyers is that mortgage rates are forecasted to decrease, even as more buyers re-enter the market, potentially escalating home bidding wars. Meanwhile, sellers seem indecisive about their next steps, contributing to an ongoing tight inventory that could pose difficulties.

Education is the Key

Whether you're looking to buy or sell, navigating the complexities of the real estate market requires the expertise of a knowledgeable guide to ensure well-informed decisions. I am happy to offer an informative presentation enriched with actual data to help you understand. We understand that everyone absorbs information differently. So, we'll be able to personalize our approach to suit your unique learning style. Whether you comprehend better through visuals, diagrams, or charts, we adapt our methods accordingly. This way, we ensure the information is accessible, digestible, and relevant, empowering you to make the best decisions for you and your family.