Is now the Time to Buy a Home in Los Angeles? Understanding the Market and Challenges

Is it a Good Time to Buy a Home in Los Angeles?

Los Angeles is one of the most desirable cities in the world, attracting millions of visitors each year with its sunny weather, diverse culture, and endless opportunities. But is it a good time to buy a home in Los Angeles? With rising housing prices and a shortage of available properties, many prospective homebuyers may wonder if now is the right time to purchase. Keep in mind, in most neighborhoods, the price per square foot has doubled since the housing crash, showcasing the market's resilience.

The Current State of the Los Angeles Real Estate Market

According to recent data from Zillow, prices are expected to rise by 9.4% over the next year. It's important to note that Los Angeles is a unique market with high demand and limited supply. The city is known for its tight-knit neighborhoods, diverse communities, and thriving job market, making it an attractive location for homebuyers.

The Low Inventory Dilemma: Causes and Projections for the Future

The Los Angeles real estate market, is presently caught in the clutches of low inventory and skyrocketing demand. Prospective buyers need more options as fewer and fewer homes are put up for sale. Many homeowners are holding onto their properties, lured by lower interest rates that they locked in during the pandemic. Adding to this already challenging scenario is the specter of economic uncertainty stemming from factors like inflation, and geopolitical instability is a concern. Property taxes represent a significant burden for homeowners, particularly those looking to sell their current homes and buy new ones. With all these challenges on their plate, it's not surprising that sellers have a lot on their minds as they contemplate the complexities of the current market and opt-out, thus creating a low inventory environment.

The low inventory problem in the housing market will persist for years due to under-building, population growth, increased housing demand, and the impact of pandemic-induced locked-in interest rates.

Thinking outside the box to secure a home in today’s market

Despite the challenges posed by the current real estate market, many experts still consider buying a home in Los Angeles an excellent opportunity. The city's housing prices continue to climb steadily, with no signs of slowing down. The great thing about Los Angeles is that it boasts a variety of neighborhoods, each with unique characteristics and price ranges. From Boyle Heights to Santa Monica or downtown Los Angeles, there is a broad spectrum of properties to choose from, allowing you to find a home that fits your budget.

Navigating the Challenges of Buying a Home in Los Angeles with the Help of a Realtor

Purchasing a home in Los Angeles can be challenging due to intense competition, which may require buyers to act quickly and make competitive offers to secure a property. However, having a reliable realtor like myself on your side can help guide you through the process and ensure you are well-informed and equipped to make the best decision for your current situation.

The Appeal of Buying a Home in Los Angeles: A Safe Bet for Real Estate Investment

Los Angeles has a diverse and dynamic economy, with various industries contributing to its growth and prosperity. These industries include entertainment, tourism, technology, healthcare, aerospace and defense, international trade, and music. Major companies such as TikTok, Yahoo, Sony, and Fox Studios have a significant presence in Los Angeles, and numerous tech companies like Google and Facebook. The city also hosts major award shows, Grammy, Oscars, and record labels that draw thousands of visitors and generate significant revenue. The diversity of the city's economy provides opportunities for professionals across various fields, making Los Angeles an attractive destination for people from all walks of life. As a result, real estate remains a significant asset for building equity.

Factors to Consider Before Committing to a Home: Life Goals, Equity, and Capital Gains Taxes

It is recommended to remain in a home long enough to benefit from rising property values and build equity that exceeds the costs of buying and selling, including commissions and mortgage closing costs, which usually take a few years. Selling the property before two years could also result in capital gains taxes if the home appreciates. These factors can help you decide how long to live in a particular location.

Understanding the Cost of Buying a Home: Down Payment and Closing Costs

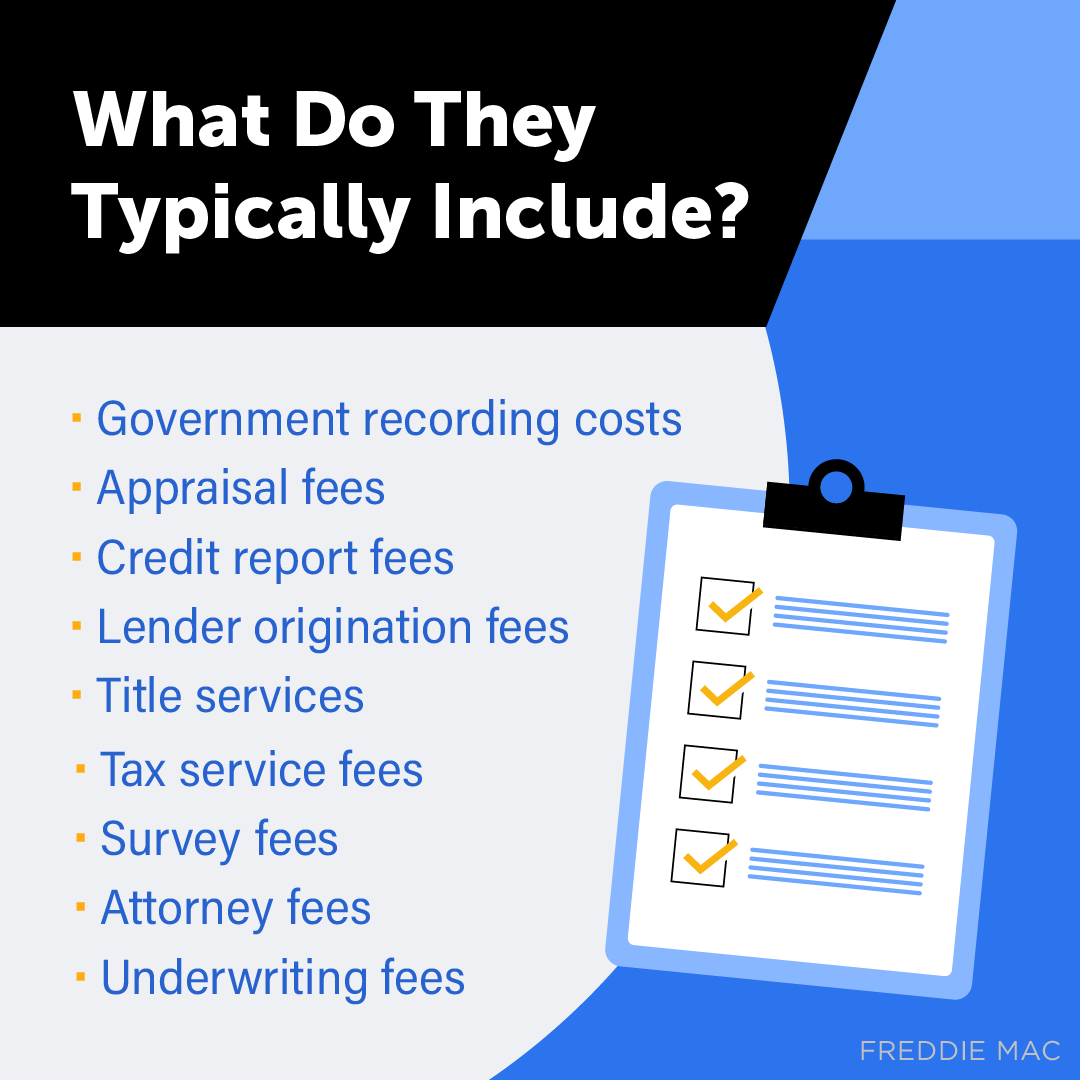

Preparing for expenses, such as down payment, closing costs, and moving fees, is essential when considering buying a home. The down payment requirement varies depending on the type of mortgage. Generally, a higher down payment will lead to lower monthly mortgage payments. According to a survey conducted by NAR, first-time homebuyers typically put down a 6% down payment, while repeat buyers put down a 17% down payment. It's worth noting that the initial purchase price doesn't include additional closing costs, which can amount to approximately 2 to 6 percent of the property's value.

Closing Cost, What are they? The cost will vary whether you are getting a loan or paying cash.

Should you wait to buy in 2023?

The forecast appears promising; per Fannie Mae's projection, 30-year mortgage rates are anticipated to average 6.3 percent in 2023 before descending to 5.7 percent the following year. It could make sense to wait out the market.

Lessons from Past Recessions: Mortgage Rates and Home Prices

What if there is a recession? Home prices may not necessarily decrease during a recession as they have often risen. This is because economic slowdowns usually lead to a decline in mortgage rates. While history cannot predict future events, we can learn from it. In the past six recessions, mortgage rates have consistently fallen, providing insight into what may happen in future economic downturns. You may refinance to take advantage of lower rates if you have job security.

Conclusion

Whether it's a good time to buy a home in Los Angeles depends on your financial situation, life objectives, and readiness to become a homeowner. Before deciding, you should evaluate your savings, job security, and overall expenses.

The 2023 Housing market is expected to be turbulent for the real estate market due to high mortgage rates and the possibility of a recession. While waiting for lower rates may increase homebuyers' affordability, it can also result in heightened competition and a frenzied environment. However, the current market has lower competition for buyers, making it a good time to purchase a home. Those who wait for lower rates may pay a higher price due to increased demand from other buyers. As such, it may be advisable to purchase now and refinance when rates eventually decrease.

As your trusted realtor, we can help you navigate the market and find the perfect home that fits your budget and lifestyle. Take advantage of this opportunity to own a piece of this dynamic and exciting city. Call us today to start your home-buying journey.